How AI will actually transform Accounts Payable

Nanonets

JUNE 7, 2023

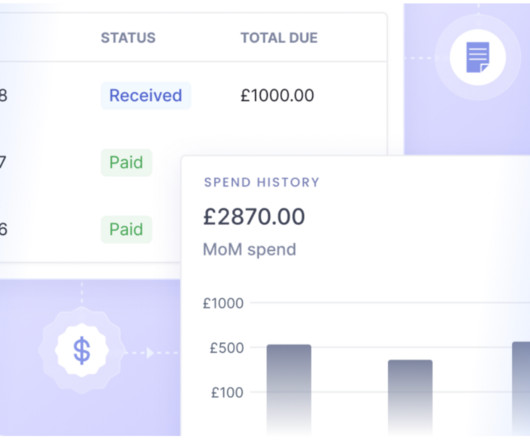

Artificial intelligence is now being applied across professional domains that are ripe for automation - areas of work such as software, law, accounting, consulting, finance and so on. It is also time-consuming, requiring significant man-hours to reconcile accounts, generate reports, and perform financial analysis.

Let's personalize your content