5 Scam Protections Customers Want from Their Bank

FICO

MAY 3, 2023

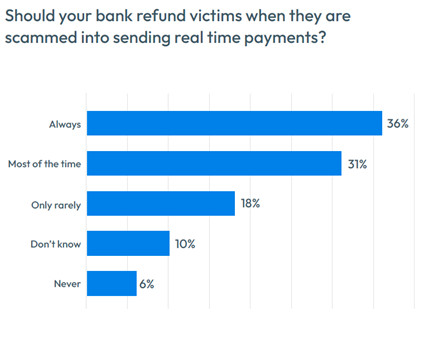

In the 2023 FICO Global Scams Survey , we asked consumers worldwide what they think banks could do better to combat scams and create a better customer experience for victims. In some markets, like Malaysia and Indonesia , this figure exceeds 75%, though in Germany only half of consumers agree.

Let's personalize your content