RT2: A strategic transformation for UK payment providers

The Payments Association

JUNE 9, 2025

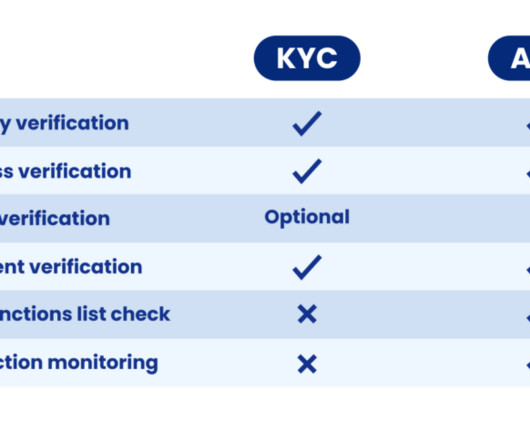

Pegeman Khorsan Chief legal and regulatory officer, RTGS.global "With new, ecosystem role-specific software, the structured data approach in RT2/ISO 20022 represents a competitive advantage in risk decisions and compliance, materially reducing costs, time, and errors.

Let's personalize your content