SOX VS SOC – Mapping the Differences

VISTA InfoSec

OCTOBER 26, 2023

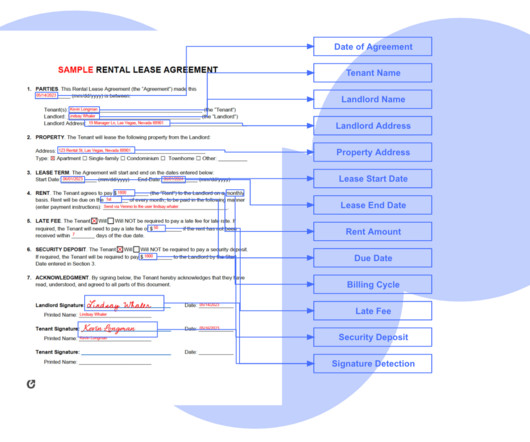

SOC and SOX represent two pivotal compliance frameworks that help maintain financial reporting integrity and data security. The SOC framework includes multiple internal control audit reports. While SOC 1 aligns with SOX’s financial reporting controls, SOC 2 focuses on ensuring service providers handle data securely.

Let's personalize your content