Higher Limits Power B2B Real-Time Payment Volumes

Trade Credit & Liquidity Management

JUNE 24, 2025

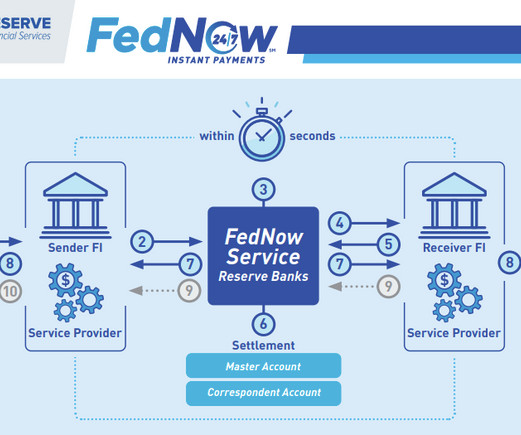

The Clearing House raised the real-time payments (RTP) transaction limit from $1 million to $10 million in February 2025. real-time payments processed for corporate clients. Rival network FedNow raised its own limit from $500,000 to $1 million on June 24, 2025. Federal Reserve.

Let's personalize your content