SNEAK PEAK: Unveiled: 2024 Key Financial Crime 360 findings

The Payments Association

APRIL 7, 2025

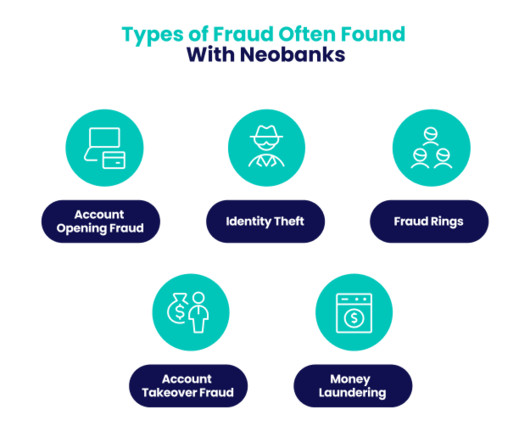

SNEAK PEAK: Unveiled: Key Financial Crime 360 findings July 16, 2024 by Payments Intelligence LinkedIn Email X WhatsApp What is this article about? The findings of the Financial Crime 360 survey, focusing on the challenges, prevalent fraud types, and strategic responses across various sectors. Why is it important?

Let's personalize your content