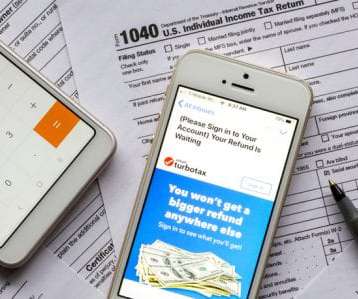

IRS Launches Consumer Portal For Getting Stimulus Checks

PYMNTS

APRIL 10, 2020

A new IRS portal for coronavirus relief payments has been launched in conjunction with the U.S. citizens and resident aliens who are not claimed as dependents and had gross income below $12,200 ($24,400 for married couples) in 2019, according to the IRS site. Treasury to assist people who don’t typically file taxes. .

Let's personalize your content