FinCEN Director Talks Digital Identity And Fraud Protection

PYMNTS

SEPTEMBER 24, 2019

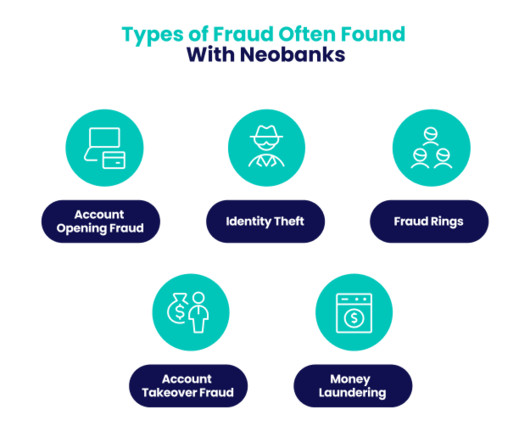

One of the biggest problems, Blanco said, is account takeover. . Account takeover, which involves the targeting of financial institution customer accounts to gain unauthorized access to funds, is an extremely common cybercrime affecting U.S. financial institutions,” he said.

Let's personalize your content