US Businesses Cling to Check Payments Despite Risk of Fraud, New Data From Codat Reveals

Fintech Finance

SEPTEMBER 24, 2024

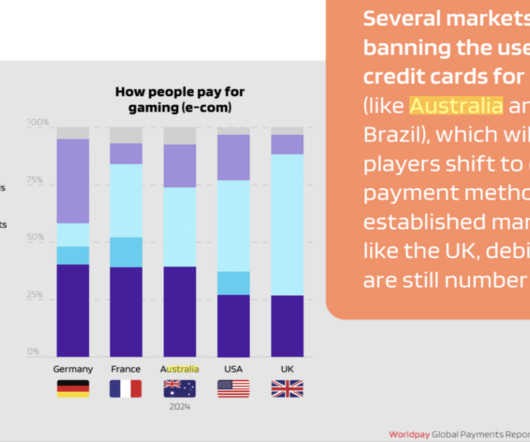

“Our data suggests that businesses are starting to care more about security than cost savings when considering alternative payment methods, so there’s a real opportunity for banks to emphasize the strengths of electronic payments and API-based data sharing in this area to accelerate the transition.”

Let's personalize your content