FICO’s New AML Scores Use AI and Machine Learning to Detect More Money Laundering

FICO

JUNE 9, 2022

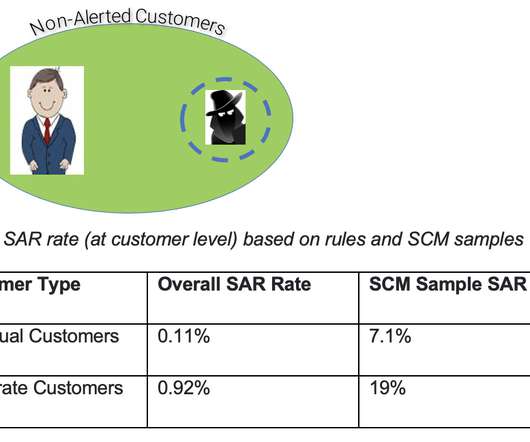

FICO’s New AML Scores Use AI and Machine Learning to Detect More Money Laundering. New AML scores reduce false positive alerts by 50% while detecting 100% of known money laundering transactions, and discover new aberrant, potentially risky behaviors. asokolowski@speednet.pl. Fri, 06/03/2022 - 12:24.

Let's personalize your content