AI x Payments: From Fraud Detection to Hyperpersonalised Checkout

Finextra

JUNE 25, 2025

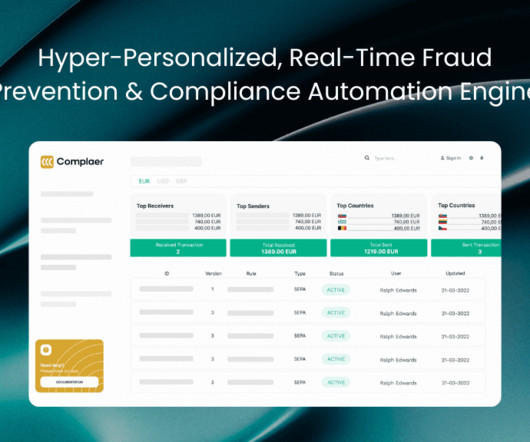

What began as a tool for basic automation has evolved into a powerful intelligence layer, quietly reshaping how we fight fraud, route transactions, and deliver seamless, personalised payment experiences. Real-Time Fraud Detection: Defence at Machine Speed Traditional fraud systems rely on static rules and after-the-fact analysis.

Let's personalize your content