A Complete Guide to Securely Process Credit Cards in Sage 100

EBizCharge

MARCH 18, 2025

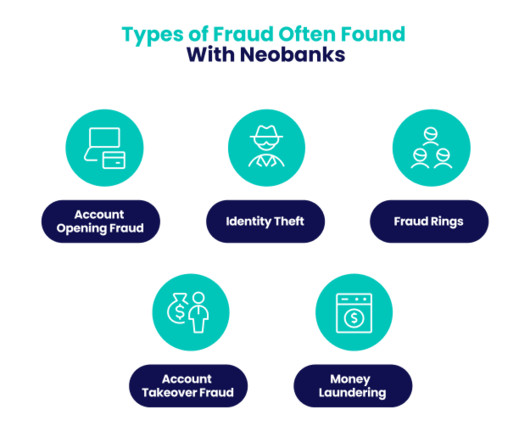

A secure payment processing provider for Sage 100 will also give merchants access to fraud detection and prevention tools, 3D Secure, chargeback management, and more. By protectin g payments in Sage 100, your company can reduce the risk of data breaches and fraud, ensuring a secure experience for all parties involved.

Let's personalize your content