Demystifying Credit Card Interchange Fees: What You Need to Know [2024 Rates and Updates]

Stax

DECEMBER 20, 2023

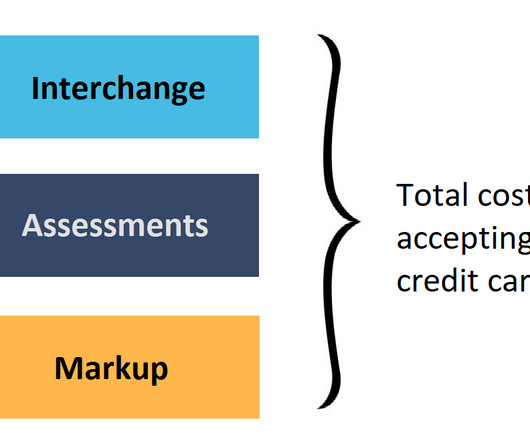

Interchange fees are simply a cost of doing business. Understanding the concept of interchange fees is crucial for businesses looking to optimize their payment processing costs. Regulated: 0.05% + $0.21 Regulated: 0.05% + $0.21 Regulated: 0.05% + $0.21 Regulated: 0.05% + $0.21 Regulated: 0.05% + $0.21

Let's personalize your content