India in Talks to Forge New Cross-Border Payment Linkages, Says RBI

Fintech News

NOVEMBER 21, 2024

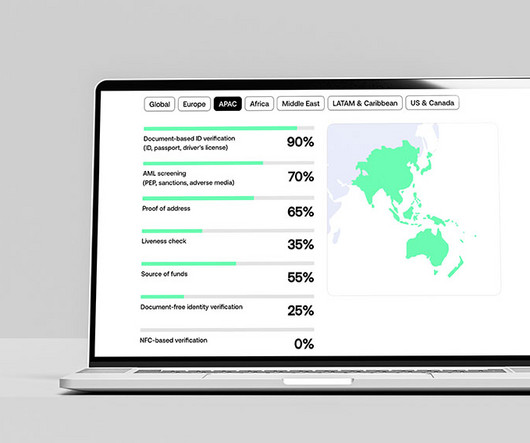

Additionally, the RBI is collaborating with central banks across Southeast Asia to create a platform enabling instant cross-border transactions, aligning with the region’s push for financial integration. India’s initiatives are also closely tied to its exploration of central bank digital currencies (CBDCs).

Let's personalize your content