Melissa, Allscripts Tackle Medical Billing Problem

PYMNTS

OCTOBER 1, 2020

Valid patient addresses and contact data are crucial for today’s healthcare industry, particularly during a pandemic.

PYMNTS

OCTOBER 1, 2020

Valid patient addresses and contact data are crucial for today’s healthcare industry, particularly during a pandemic.

Fintech News

JANUARY 30, 2024

PvP ensures that the final transfer of a payment in one currency only occurs once the corresponding transfer in another currency is completed. Commercial banks are at the forefront of this movement, developing deposit tokens that correspond to the existing deposits held by these banks.

Stax

JANUARY 21, 2025

Some businesses may receive multiple terminals, which helps reduce physical payment processing costs. Once youve established your criteria, create a comparison matrix where one row represents a payment gateway and each column corresponds to a criterion. How to Evaluate and Compare Payment Gateways Step Details 1.

Nanonets

MAY 23, 2025

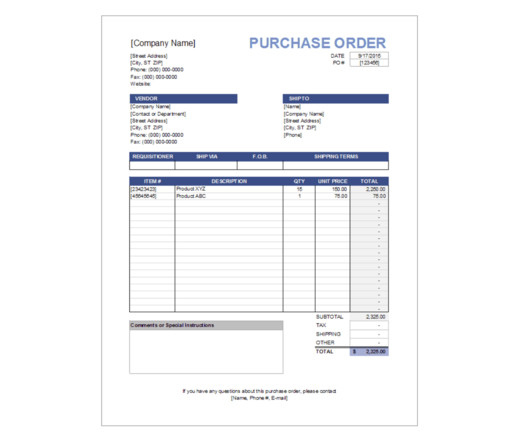

2,106 invoice vs $3,138 PO) Line item quantities differ from ordered quantities Shipping quantities don't match ordered quantities Prices have changed from the original PO For example, when processing an invoice, the system automatically pulls the corresponding PO from QuickBooks and compares each line item.

Fintech Finance

APRIL 17, 2024

StoneX’s API-driven financial institution platform and extensive network of over 350 correspondent banks will be leveraged. NatWest continues to support the global ambitions of our customers with payment currency choices that enable them to choose from a broader supplier network with reduced processing cost and access to improved terms.”

Nanonets

MARCH 14, 2024

For this, all details of the purchase as mentioned in the invoice are matched with the corresponding purchase order to ensure that the product/services that were ordered were delivered correctly and at the price agreed upon. This verification process is called 2-way matching. How to automate 2-way matching?

BNG Payments

JANUARY 2, 2022

Tiered pricing is the different rates applied to merchants based on their average monthly processing volume. Tiered pricing merchant accounts allow you to choose from three or more tiers with corresponding card swipe fees: the higher your average monthly volume, the lower your rate for each interchange category. How Does It Work?

Let's personalize your content