What are Payment Reversals? Why Do They Happen & How Can Merchants Stop Them?

Fi911

MAY 22, 2024

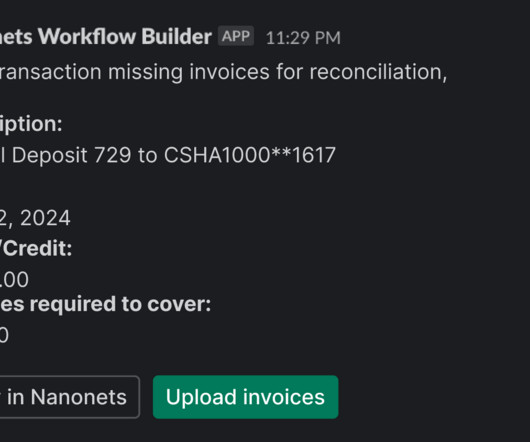

This process can be triggered for various reasons, such as a disputed charge, an error in the transaction, or fraud detection. Different types of payment reversals exist, each with distinct procedures and implications. Also, implement fraud detection systems to identify and mitigate suspicious transactions.

Let's personalize your content