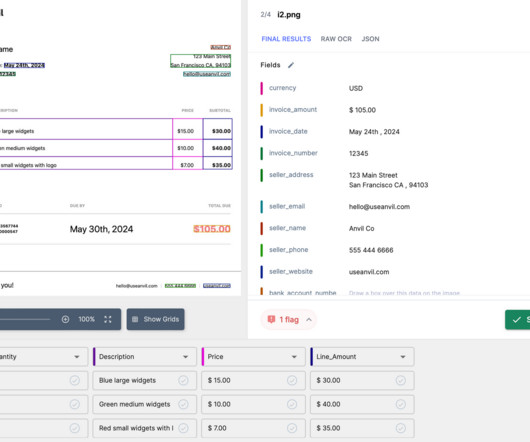

EBizCharge Supports High-Volume Credit Card Processing Services

EBizCharge

JUNE 3, 2025

As a leading provider of integrated payment solutions, EBizCharge offers tailored services that support the complex needs of high-volume businesses, helping them streamline payment processing operations, improve cash flow, and reduce processing costs. Luckily, EBizCharge can help.

Let's personalize your content