Stripe partners with Nvidia, Pepsi and Rivian

Payments Dive

OCTOBER 11, 2024

The payments software provider announced a slew of new partnerships on Wednesday, also with Amazon and AMC Networks.

Payments Dive

OCTOBER 11, 2024

The payments software provider announced a slew of new partnerships on Wednesday, also with Amazon and AMC Networks.

Bank Automation

OCTOBER 11, 2024

JPMorgan Chase expects AI and other new tech to increase employee productivity but remains wary of AI tech companies’ inflated valuations. “Tech valuations, or any valuations, won’t stand these very inflated values,” Chief Executive Jamie Dimon said during the bank’s third-quarter earnings call today. The bank has a significant cash surplus “sitting in the store” […] The post JPMorgan Chase warns of inflated AI tech valuations appeared first on Bank Automation News.

Payments Dive

OCTOBER 11, 2024

The department’s undersecretary for domestic finance, Nellie Liang, suggested state oversight of money transmitters was outdated in an era of electronic payments.

Fintech Finance

OCTOBER 11, 2024

Klarna , the AI-powered global payments network and shopping assistant, has released data on its launch of cashback. In the six weeks since launch: 506,378 Klarna shoppers have earned $2.7m dollars in cashback. Klarna merchants have given cashback on $98.4m worth of sales. Over 1,000 cashback promotions have been launched. Klarna launched cashback in 12 countries simultaneously on 15 August, to reward consumers who shop in the Klarna app.

Speaker: Jason Cottrell and Gireesh Sahukar

Retailers know the clock is ticking–legacy SAP Commerce support ends in 2026. Legacy platforms are becoming a liability burdened by complexity, rigidity, and mounting operational costs. But modernization isn’t just about swapping out systems, it’s about preparing for a future shaped by real-time interactions, AI powered buying assistants, and flexible commerce architecture.

Finovate

OCTOBER 11, 2024

This week’s edition of Finovate Global features news from the fintech scene in Hong Kong. Worldline partners with BOCHK International payment services company Worldline has forged a partnership with the Bank of China (Hong Kong), also known as BOCHK. The partnership makes the bank the first Hong Kong-based customer of Worldline’s open platform card solution, Paysuite Essential Edition.

Finextra

OCTOBER 11, 2024

This article was co-authored with Stacy Dubovik, ScienceSoft's Financial Technology and Blockchain R.

Payments Space brings together the best content for payment processing professionals from the widest variety of industry thought leaders.

The Payments Association

OCTOBER 11, 2024

We’re excited to introduce our latest product for fintechs and payment service providers: Customer Virtual Accounts. We’ve been helping fintechs to meet customer demand for stablecoin payments since 2019. As businesses increasingly look for faster, cheaper ways to move money across borders, the need for flexible solutions that bridge fiat and stablecoin transactions is growing.

Fintech Finance

OCTOBER 11, 2024

ClearBank , the enabler of real-time clearing and embedded banking, today announced it has successfully onboarded its first European clients to the Eurosystem’s payment rail, T2. The fintech clearing bank welcomes OpenPayd, Pay Perform (which trades as Orbital), and Transact Payments, which will all benefit from real-time transactions in Euros. T2 is the real-time gross settlement (RTGS) system owned and operated by the Eurosystem.

Payments Next

OCTOBER 11, 2024

By Scott Dawson, CEO, DECTA To keep fit and healthy, I train in Muay Thai at my local gym every Saturday morning. The post Managing Risk Balanced by Strategy first appeared on Payments NEXT.

Fintech Finance

OCTOBER 11, 2024

The ai Corporation (ai), the leading provider of payments and fraud management solutions, today announced the appointment of Mark Wheelhouse as its new Chief Financial Officer. Wheelhouse will lead ai’s finance department and play a key role in driving the company’s ambitious growth strategy in the retail fuel, mobility payments and fraud management markets.

Speaker: Michael Veatch, Senior Director, Implementations & Ella Aguirre, Director of Solution Consulting

Embedding payments can be a transformative step for software companies looking to enhance their platform capabilities, boost customer satisfaction, and drive long-term growth. However, the success of payments hinges on a single thing: implementation. Drawing on real-world insights and experiences, payments implementation experts Michael Veatch and Ella Aguirre will explore actionable strategies that can lead to a transparent, friction-free launch and mitigate potential challenges like technical

Basis Theory

OCTOBER 11, 2024

Token Create Speed Improvements We’ve significantly improved our tokens' speed for both Token Creations and Reads over the last few months—and customers should have noticed them already. This speed and reliability is designed to ensure tokens can always be created and meet the needs of the latency SLAs as we know we are in a major part of the flow of our customers.

Fintech Finance

OCTOBER 11, 2024

AMAN Union , the leading professional forum for commercial and non-commercial risk insurers and reinsurers in member countries of the Organization of Islamic Cooperation (OIC), has signed a Corporate Training Services Agreement with RISC Institute DMCC, a renowned training institution specializing in talent development for the insurance, risk management, personal finance sectors, based in the United Arab Emirates and operating regionally.

The Payments Association

OCTOBER 11, 2024

What is this article about? The Financial Conduct Authority’s (FCA) proposed reforms to strengthen consumer fund safeguarding in the payments and e-money sectors. Why is it important? The reforms aim to address weaknesses in safeguarding practices, reduce consumer fund risks, and enhance regulatory compliance, particularly in preventing fund shortfalls.

Fintech Finance

OCTOBER 11, 2024

TD Bank Group (“TD” or the “Bank”) (TSX: TD) (NYSE: TD) today announced that, following several years of active cooperation and engagement with authorities and regulators, it has reached a resolution of previously disclosed investigations related to its U.S. Bank Secrecy Act (BSA) and Anti-Money Laundering (AML) compliance programs.

Speaker: Benjamin Woll, Tiffany Spizzo, and Jaime Santos Alcón

Enterprise commerce is at an inflection point. Rigid, monolithic platforms slow brands down, but a full replatforming is disruptive and costly. Modular architecture offers a flexible, scalable alternative - allowing enterprise brands to modernize without ripping and replacing their entire stack. Learn how a composable approach helps modernize commerce stacks while maintaining control over critical systems.

Payments Dive

OCTOBER 11, 2024

The tech company was unable to secure the funding needed to continue operating, a spokesperson said.

Fintech Finance

OCTOBER 11, 2024

Today, Citi and Mastercard announced a collaboration to offer cross-border payments to Mastercard debit cards in 14 receiving markets [1] worldwide, with plans for further expansion. Leveraging Citi’s WorldLink® Payment Services and Mastercard Move’s money transfer capabilities, Citi clients can make near-instant, full-value payments, with near 24/7 availability to consumers using their Mastercard debit card details.

The Paypers

OCTOBER 11, 2024

Sift , an AI fraud protection platform that secures digital trust, has been selected by Alaska Airlines to mitigate payment fraud and manage chargeback disputes, while optimising the customer experience.

Bank Automation

OCTOBER 11, 2024

Wells Fargo trimmed its staff and total costs in the third quarter, with efficiency in mind. “We have maintained strong credit discipline and driven significant operating efficiencies in the company while investing heavily to build a risk and control infrastructure appropriate for a bank of our size,” Chief Executive Charlie Scharf said during today’s Q3 […] The post Wells Fargo’s tech spend up and headcount down in Q3 appeared first on Bank Automation News.

Advertisement

Large enterprises face unique challenges in optimizing their Business Intelligence (BI) output due to the sheer scale and complexity of their operations. Unlike smaller organizations, where basic BI features and simple dashboards might suffice, enterprises must manage vast amounts of data from diverse sources. What are the top modern BI use cases for enterprise businesses to help you get a leg up on the competition?

The Paypers

OCTOBER 11, 2024

Grasshopper Bancorp and Auto Club Trust have announced that they have entered into a definite merger agreement, expected to close in the first half of 2025.

Finextra

OCTOBER 11, 2024

In today’s highly dynamic financial world, the necessity of viable solutions that allow unbanked and.

The Paypers

OCTOBER 11, 2024

tbi bank has revealed plans to launch its own tech hub, aimed at developing and integrating its services while broadening access to the international market.

The Fintech Times

OCTOBER 11, 2024

Alkami Technology , a US and cloud-based digital banking solutions provider, has partnered with Intrepid Credit Union to launch a new digital banking platform that offers members self-service tools and a personalised user experience. The Alkami Digital Banking Platform hopes to enable Intrepid Credit Union to foster greater engagement and growth for the members they serve.

Speaker: Becky Parisotto and John Vurdelja

Fulfillment is no longer just about getting products from point A to point B – it's about crafting seamless, scalable, customer first experiences. Flexible fulfillment strategies are more important than ever for those aiming to stay ahead and build resilience as retail enters a new era in 2025. Learn how to optimize fulfillment processes, tackle complex, multi-vendor orders, and create seamless customer experiences – from white-glove delivery for high-value items to quick-ship solutions for ever

Finextra

OCTOBER 11, 2024

The owner-managed family office Lennertz & Co. is continuing its family of funds of funds for investments in innovative blockchain technologies, launching Blockchain Fund III. The strategy focuses on targeted investments in blockchain technology by investing in companies that build and develop the blockchain infrastructure.

The Fintech Times

OCTOBER 11, 2024

Digital payments provider Checkout.com has become the first payment service provider (PSP) to add Octopus , Hong Kong’s first homegrown global fintech, as a payment option at checkout. Through the new collaboration, Checkout.com will make Octopus more accessible to merchants, as well as enhancing their payment performance. Checkout.com’s offering includes the integration of Octopus’s online payment solutions through the Octopus mobile app.

Finextra

OCTOBER 11, 2024

The FinTech Impact Report 2024 reports that the UK fintech sector has improved financial inclusion and sustainable initiatives across the country.

The Fintech Times

OCTOBER 11, 2024

Bridging the worlds of fiat currencies and blockchain, Visa , the digital payments firm, has launched its new Visa Tokenized Asset Platform (VTAP). The new Visa product is designed to help financial institutions issue and manage fiat-backed tokens on blockchain networks. The VTAP solution is available on the Visa Developer Platform for participating financial institution partners, to create and experiment with their own fiat-backed tokens in a VTAP sandbox.

Speaker: Brad Pinneke, VP of Business Development at Payrix and Worldpay for Platforms

In this webinar, Brad Pinneke, Vice President of Business Development at Payrix and Worldpay for Platforms, will dive into the 7 must-have criteria for evaluating payments partners, helping you maximize both efficiency and the long-term value of your investment. From assessing technology capabilities to leveraging business development opportunities, this session will give you a clear, actionable strategy to select the right partner for scaling your business.

Finextra

OCTOBER 11, 2024

Introduction As European banking institutions quickly face up to key 2025 events for SEPA Instant co.

The Fintech Times

OCTOBER 11, 2024

On 22 – 24 October, the Riyadh Front Centre will play host to the next iteration of Seamless Saudi Arabia , as it returns for its third event. Drawing from the success of Seamless Saudi Arabia 2023 and leveraging the payments infrastructure in the Kingdom, Seamless Saudi Arabia is renewing its partnership with the national payments scheme, mada.

Finextra

OCTOBER 11, 2024

Despite the rise of digital transformation and eCommerce, the future still looks bright for brick-a.

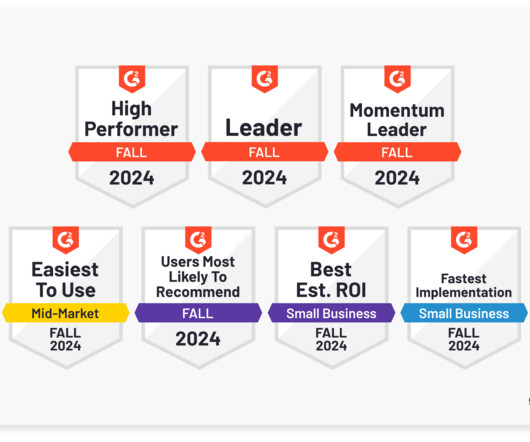

EBizCharge

OCTOBER 11, 2024

EBizCharge is recognized as a High Performer, Momentum Leader, Easiest to Use, Users Most Likely to Recommend, and more in the Fall 2024 G2 report, ranking competitively among top payment gateways and payment processors in the industry. EBizCharge is a top-rated payment software provider with an all-in-one platform that combines a payment gateway, merchant services, and robust payment integrations.

Speaker: Jennifer Wright and Nick Barron

2025 is right around the corner, and with it comes a new wave of consumer expectations, competitive pressures, and operational challenges. Success lies in finding the balance between operational flexibility and creating experiences that keep customers coming back. The future of retail belongs to those who can stay ahead of shifting customer preferences and marketing trends. 🔮 In this session, we’ll dive deep into what it takes to keep customers engaged and your operations nimble, no matt

Let's personalize your content