U.S. Faster Payments Council Shares Results from 2025 Faster Payments Barometer

Fintech Finance

FEBRUARY 20, 2025

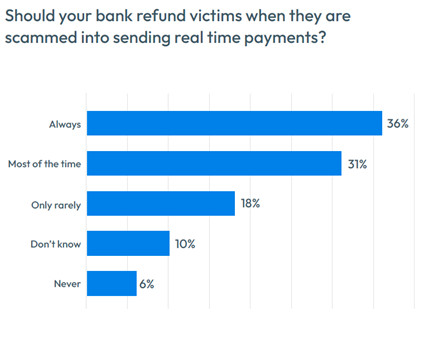

The results reflect growing adoption of the FedNow Service and RTP Network and an expanding array of use cases in both consumer and business contexts. Use Case Expansion: Businesses are most interested in leveraging faster payments for eCommerce (54%), point-of-sale transactions (51%), and invoicing/supplier payments (41%).

Let's personalize your content