Where Challenger Banks & Incumbents See The Next Digital Banking Opportunity

CB Insights

JANUARY 5, 2021

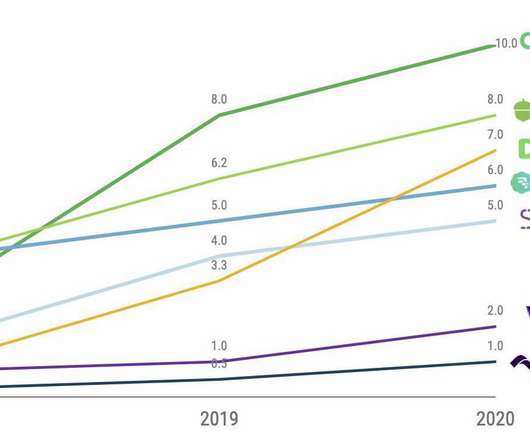

In contrast, online banking in the US has surged with 73% of consumers using it regularly, up from 46% in 2010. . This older demographic also accounted for 20% of those who deposited mobile checks for the first time. . Source: FDIC. Alternative services can be costly.

Let's personalize your content