How to Choose Between EFT vs ACH: A Comprehensive Guide

Stax

MARCH 27, 2025

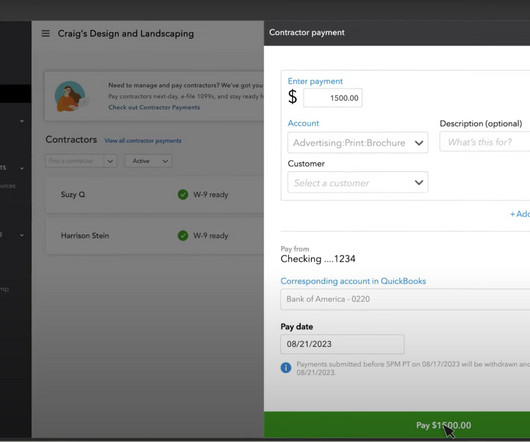

Thats why 92% of consumers and 82% of companies reportedly made the switch to electronic payments, like Electronic Funds Transfers (EFT) and Automated Clearing House (ACH). EFT and ACH payments are fast, secure, and hassle-free. Another EFT type that businesses rely on is ACH. Lets look into that closely below.

Let's personalize your content