How To Integrate a Payment Gateway into Sage Software

EBizCharge

MARCH 20, 2025

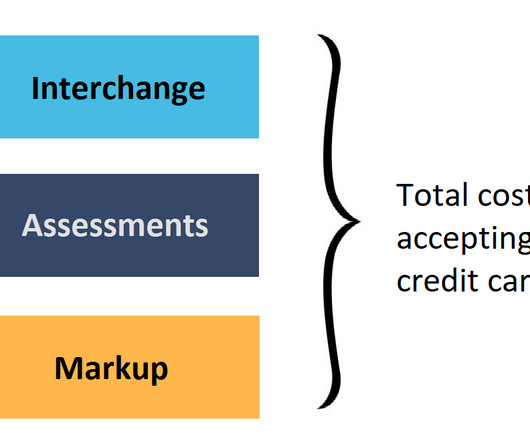

Consider payment processing costs and ensure the provider complies with industry standards like PCI Compliance. Reviewing each providers functionality, payment collection tools, payment security, costs, and customer support will enable your business to make the best decision. Whats a settlement period?

Let's personalize your content