SEON launches AI-powered anti-money laundering suite

The Paypers

JUNE 12, 2025

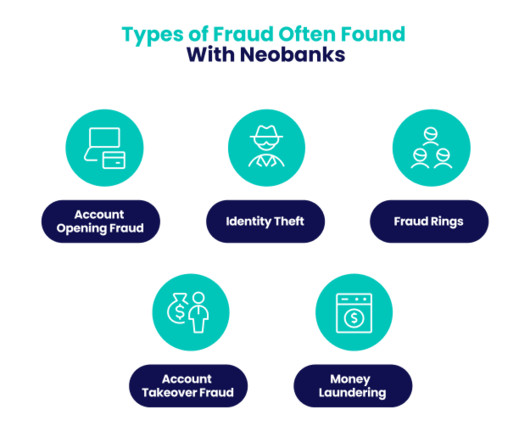

Following this announcement, the company’s expanded offering will integrate fraud prevention and AML compliance, aiming to provide teams with access to a single platform to screen and monitor customers in real-time, manage alerts, investigations, and regulatory reporting.

Let's personalize your content