Understanding PCI DSS, PSD2, and AML in Payment Processing: A Practical Guide

Finextra

JUNE 26, 2025

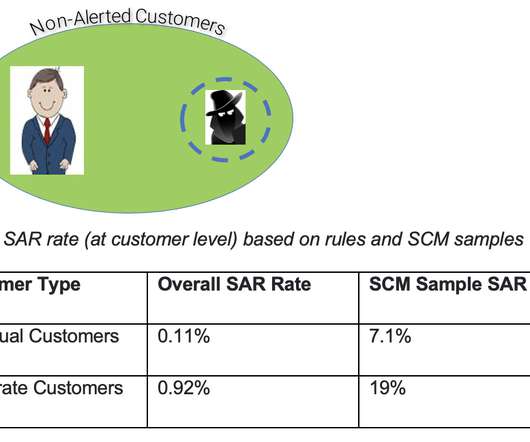

Core AML requirements you must follow Here’s what you need to put in place: Know Your Customer (KYC) checks Real-time transaction monitoring Risk-based assessments Suspicious Activity Reports (SARs) These steps help you identify and stop illegal transactions before they harm your business. It expresses the views and opinions of the author.

Let's personalize your content