Blink Payment Enters B2B Fashion Payments with Zedonk Partnership

Fintech Finance

NOVEMBER 13, 2024

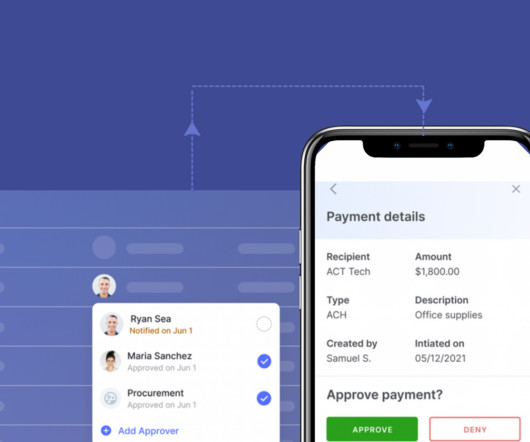

Traditionally, brands have lacked the payment infrastructure that enables retailers to settle invoices via methods other than bank transfer – which can be expensive, slow and lead to late payments. Through payment links, retailers can settle their invoices in a faster, more convenient and more secure way compared to bank transfer.

Let's personalize your content