Payment reconciliation: What is it, and how can your business do it efficiently?

Nanonets

JUNE 21, 2023

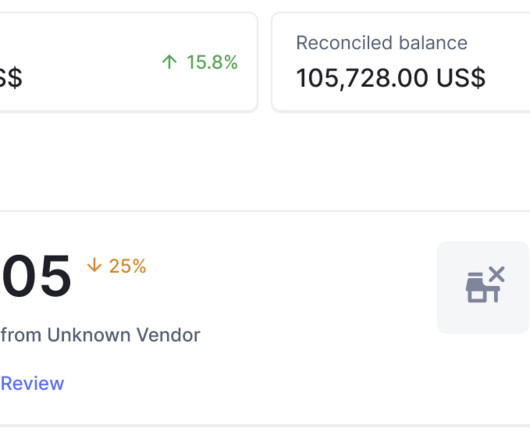

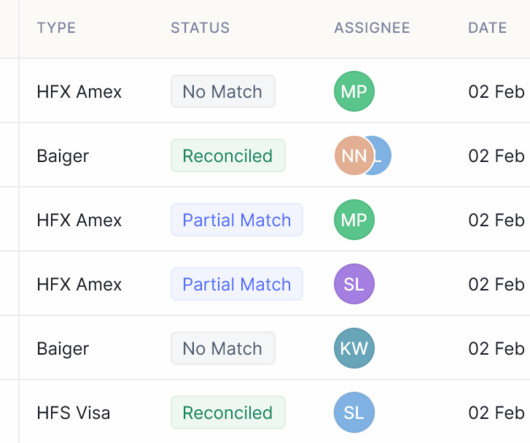

This article will provide a comprehensive guide to reconciling payments, its importance, challenges faced, best practices, and the role of automation in enhancing the process. This process helps identify any missing or unmatched payments, duplicate transactions, or other errors that may impact the financial records.

Let's personalize your content