Economic Crime and Corporate Transparency Act examined: A guide to avoiding failure-to-prevent fraud measures

The Payments Association

FEBRUARY 10, 2025

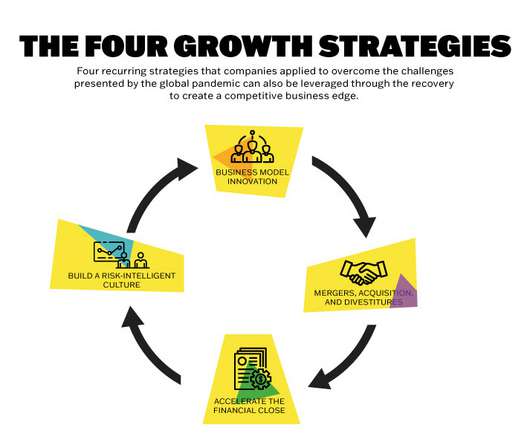

The Economic Crime and Corporate Transparency Act 2023, specifically the “failure-to-prevent fraud” offence, and outlines how businesses can mitigate fraud risks. Compliance requires proactive fraud risk assessment, the implementation of preventive procedures, and a culture of accountability. Why is it important?

Let's personalize your content