What is a BIN in Payment Processing

Clearly Payments

NOVEMBER 13, 2024

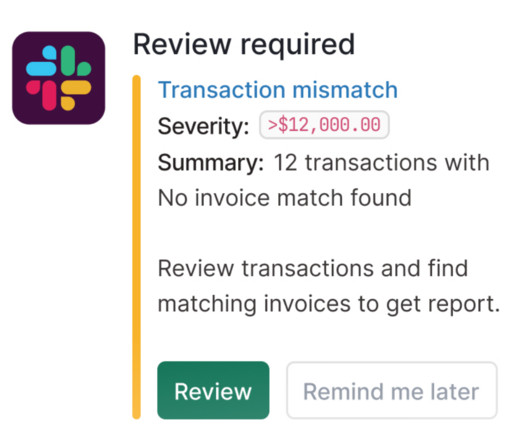

The role of the BIN extends beyond simply identifying the card issuer; it affects various aspects of the payment process: Transaction Routing : When a customer makes a purchase using a card, the payment processor uses the BIN to route the transaction to the right financial institution. Why is the BIN Important in Payments?

Let's personalize your content