How EMV has grown beyond the chip on a card

Payments Source

JULY 8, 2020

The role of EMVCo — which is often seen as an extension of the card brands that deals only with chip-based EMV plastic cards— has come into sharper focus.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Payments Source

JULY 8, 2020

The role of EMVCo — which is often seen as an extension of the card brands that deals only with chip-based EMV plastic cards— has come into sharper focus.

Stax

MARCH 14, 2024

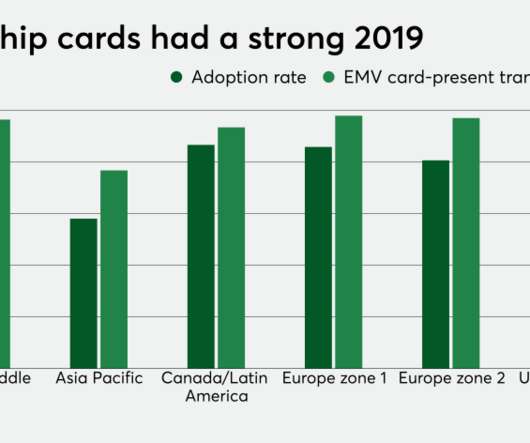

EMV (Europay, Mastercard, and Visa) chip card use has continued to expand in use since its tumultuous rollout in 2015. The EMV standard has now become a global standard for cards equipped with computer chips and the technology used to authenticate chip-card transactions.

Stax

MARCH 13, 2025

Credit and debit cards have become the preferred payment methods for many, and it isn’t hard to see why. In 2023, 27% of all point-of-sale (POS) payments were made using credit cards while 23% were made with debit cards. This is a win-win situation for issuing banks and credit card payment networks.

Stax

MARCH 6, 2025

Card emulation. This technology turns any NFC-enabled smartphone, smartwatch, or wearable into a contactless credit or debit card. Use case: Customers with mobile wallets like Apple Pay, Google Pay, or Samsung Pay can tap their NFC-enabled device on a terminal to pay as if using a physical card.

PYMNTS

FEBRUARY 13, 2019

Merchants saw a drop in card-present fraud due to the increased adoption of Europay, Mastercard and Visa (EMV) chip cards, Visa said. Merchants who have upgraded to chip technology saw a decrease of 80 percent in counterfeit fraud dollars in September of 2018 when compared to September of 2015. More than 3.1

PYMNTS

APRIL 2, 2019

Wells Fargo announced Tuesday (April 2) the launch of contactless consumer credit and debit cards. In a press release , Wells Fargo said the new cards will enable customers to complete transactions quickly and with a single tap at millions of merchants and transit systems that accept contactless payments.

Stax

NOVEMBER 14, 2024

Interchange rates vary based on the type of card you are running. The more expensive it is for the credit card company to maintain the card–rewards, cashback, perks–the more expensive the interchange. In other words, debit cards are more economical while business credit cards are typically the most expensive.

PYMNTS

NOVEMBER 22, 2016

21) that its latest chip data update showed 388 million Visa EMV cards in the U.S. Of those, the firm said there are nearly 181 million chip credit cards in the field and 208.3 million chip debit cards. million chip-active locations across the country. Visa said Monday (Nov.

PYMNTS

SEPTEMBER 4, 2019

Visa announced that since their inception, chip cards have reduced counterfeit fraud by 87 percent. . Chip cards are increasingly becoming the norm as usage and acceptance has continued to grow since the EMV standard was first introduced in 2011,” the company said. Also down were overall card-present fraud rates.

Payments Source

SEPTEMBER 13, 2016

New Orleans--As credit and debit card issuers start to see the benefits of EMV-chip card security, prepaid would seem to be the logical next step. But prepaid issuers remain unconvinced of the security benefits of EMV.

Clearly Payments

MARCH 4, 2025

Whether you run a retail store, an e-commerce business, or a service-based company, the costs of accepting credit and debit cards add up quickly. Lowering Cost with EMV Transactions One of the most effective ways to lower payment processing costs is by using EMV chip and PIN transactions.

Stax

MARCH 4, 2025

Heres what companies need to know about credit card integrations and how they can handle payments. TL;DR Online payments rely on API or hosted gateways with encryption and fraud detection, while in-store transactions require POS hardware with EMV chip technology and NFC capabilities. Need to integrate payments?

PYMNTS

SEPTEMBER 30, 2016

EMV: The three little letters that represent the single most hotly debated and discussed topic in the U.S. The walk to the liability shift in this market last October was technically four years long, but in reality, EMV didn’t become an absolute certainty until Dec. But it’s not just EMV. EMV is not only for the big guys.

Clearly Payments

MAY 22, 2025

General Terms Merchant A business that accepts credit or debit card payments. Transaction A payment made using a card or digital wallet. Issuer (Issuing Bank) The issuing bank is the bank that gave the customer their credit or debit card. Debit Card A card that pulls money directly from a bank account.

PYMNTS

OCTOBER 26, 2016

As the conference kicked off in Las Vegas last October, merchants and retailers around the United States began dealing with the effects and fallout of October’s EMV liability shift, as the technology became the standard for all retail payments. It’s EMV all over again. ” Biometrics coming on big. . Getting ahead of what’s next.

Payments Source

AUGUST 9, 2016

Three quarters of debit cards will have chips by the end of the year, but slow merchant adoption is limiting use, according to Pulse.

FICO

MARCH 7, 2016

Will problems using EMV terminals drive consumers to ApplePay and others? Those numbers are pretty good, but nothing like the 141 million-plus EMV cards that Visa now has in circulation in the US, alone. People will rush to mobile payments because they’re uncomfortable with using their new EMV cards.

FICO

MARCH 29, 2017

That means we’ll continue to see compromises - and card fraud - rise. I’ve been asked whether EMV transition is playing a role here. As ATMs aren’t yet required to be chip-card enabled, the EMV adoption that came into force last year isn’t driving fraud down yet. I think it is, but not the role you’d expect.

Stax

MAY 6, 2025

Essentially, swiping, dipping, and tapping are the three ways that customers can make in-person payments with a credit or debit card. Swiping, of course, is the oldest of the three methods and is used with a card that has a magnetic stripe (or magstripe) on it. That adds an extra layer of security.

Payment Savvy

JULY 3, 2024

Debit cards have become an indispensable part of our financial lives, with the majority of American adults, spanning all demographics, now possessing at least one debit card. Every merchant should prioritize taking the time to understand debit card processing to streamline operations and enhance customer satisfaction.

PYMNTS

OCTOBER 16, 2018

16) that for the first time, contactless payments have become more popular than chip and pin card purchases when paying in-store in the U.K. The Guardian reported that Worldpay said it was the first time it has seen contactless payments surpass chip and pin. Worldpay, the payment technology company, announced Tuesday (Oct.

PYMNTS

DECEMBER 9, 2016

No longer are they focusing on credit and debit cards — those brazen attempts have been at least partly blunted by EMV and tokenization initiatives. Now, hackers are increasing efforts to pilfer personally identifiable information (or PII, for short).

PYMNTS

FEBRUARY 23, 2018

million merchant locations now accept chip cards, covering 59 percent of the merchant population. That latest tally also includes December of last year and represents a jump of 579 percent over the beginning of the migration to EMV chip card adoption in the United States. Debit cards numbered 272.7

Payments Source

DECEMBER 26, 2016

payment card market prompted many issuers to keep things simple by sticking with contact-only chip cards when they finally moved to support EMV, but now certain issuers are taking a new tack by adding Near Field Communication technology to their chip-enabled cards. The large scale of the U.S.

Cardfellow

MAY 19, 2025

All five offer and promote EMV chip-capable credit card machines and options that can accept NFC (contactless) payments. Chances are, if youve used a credit or debit card, youve seen an Ingenico terminal. More info: CardFellows equipment directory offers reviews of many Ingenico credit card machines.

PYMNTS

AUGUST 29, 2018

merchants by 75 percent from September 2015 to March 2018 as more storefronts started accepting chip cards. To that end, Visa said that, as of its latest “Visa Chip Card Update,” as many as 67 percent of storefronts in the United States now accept chip cards. payments in June were on EMV cards.

Cardfellow

MAY 19, 2025

Some machines let you take magstripe, EMV chip, and NFC (contactless) payments while others only accept magstripe and EMV. Pictured below is a popular Verifone Vx520 model, which boasts an EMV chip slot on the bottom and a magstripe reader on the side. A basic chip-capable credit card machine starts around $300.

Stax

MARCH 5, 2025

How Can Internet Card Payment Processing Help My Business? From accepting credit cards and debit cards online to setting up your customized web store, there are various eCommerce solutions that can assist when in-person payments arent an option. But what’s the difference between these two? How do they work together?

PYMNTS

OCTOBER 25, 2016

If you’re playing the slots in Vegas this week, there’s a good chance they’re coming up: Biometrics; EMV chip cards; Mobile security. He said that biometrics could have the potential to remove the need for usernames and passwords, much the way EMV is intended to eliminate the need for cardholders to enter debit card PINs.

PYMNTS

SEPTEMBER 2, 2016

The movement to EMV and chip cards has been one of safety, but card users themselves have been disgruntled when actually using the cards.

PYMNTS

NOVEMBER 23, 2016

22) that it is working to modify its debit routing policies, saying that it has “modified and clarified” its rules to boost EMV chip card adoption in the United States. Those modifications, the card giant said, come on the heels of guidance that has been issued by the Federal Reserve. Visa said Tuesday (Nov.

Payment Savvy

DECEMBER 2, 2022

Until recently, people made their credit and debit card payments with a bit of distrust because they were afraid of scammers stealing their card information through the card’s magnetic stripe. With NFC, you don’t need to insert a card and input a PIN. This is the most typical form of contactless payment.

Clearly Payments

MARCH 28, 2024

Clover Flex Clover Flex is a compact, portable credit card machine that offers a range of features suitable for various business types. It accepts a wide range of payment methods, including contactless, chip, and magnetic stripe cards. It accepts all major credit and debit cards, including tap, chip, and swipe payments.

PYMNTS

MARCH 27, 2017

As card swipes turned to chip insertions across the U.S., Recently, to combat long lines and payments fatigue, financial, merchant service and mobile payment company Square rolled out a firmware update to its chip payment terminals. According to data from ABI Research, annual shipments of contactless cards in the U.S.

Stax

JANUARY 5, 2024

TL;DR A credit card terminal is a device commonly used by businesses to handle credit and debit card transactions. Level Up Your Terminal with Stax Card Readers What is a Credit Card Terminal? A credit card terminal is a device commonly used by businesses to handle credit and debit card transactions.

PYMNTS

NOVEMBER 1, 2016

Primark, a European clothing dealer, has reported that credit card skimming equipment was found on “a limited number of card payment machines” in two of its U.S. Simple card skimmers do not work on EMV chip cards, but as of yet, it is unknown what type of skimming devices were used.

PYMNTS

JUNE 19, 2016

On the EMV front, Home Depot decided it felt strongly enough about Chip and PIN that that it sue MasterCard and Visa over it.Walmart Canada decided it would stop accepting Visa cards since they say they are too expensive. Home Depot – Another EMV Lawsuit Joins The Party . Because in the U.S. 05 more, on average.

Fintech Labs Insights

JULY 21, 2015

Last week I received new credit cards from US Bank and Capital One, both containing microchips to support EMV terminals, the global standard finally rolling out in the United States over the next few years. The Capital One card mailer did a good job doing just that. Enhanced security with chip technology.

FICO

OCTOBER 12, 2016

As the US payment card infrastructure continues to move to EMV, fraudsters are turning their targets toward unattended self-service terminals, such as US ATMs, most of which have not yet been upgraded to read EMV chips. Debit-card compromises at ATMs located on bank property in U.S.

The Paypers

AUGUST 15, 2016

(The Paypers) Reducing credit and debit card fraud by implementing EMV chip card acceptance has become retailers’ top payment issue in 2016.

Clearly Payments

DECEMBER 2, 2024

With over 79% of consumers using credit or debit cards for transactions, businesses that do not accept cards risk losing significant sales. This article will explore the various ways businesses can accept credit cards, including their advantages, costs, and considerations. Pros Fast and secure transactions.

PYMNTS

APRIL 25, 2016

Visa is determined to make EMV faster, Starbucks wants to make getting that cuppa joe faster, too, and is crushing it with mobile order ahead and the CFPB might be moving closer to having a fast exodus of the payday lending business once its rules drop. EMV’s Second Phase. Or, at least, some of them must.

PYMNTS

NOVEMBER 14, 2018

said the rollout will be done on an ongoing basis, spanning when customers open up new accounts or have cards that are renewed. The company also said that it will debut contactless debit cards in the second half of next year. Chase , the consumer banking arm of JPMorgan Chase & Co.,

PYMNTS

AUGUST 22, 2016

With new research from Visa indicating that EMV chip-enabled credit and debit cards are gaining popularity among American consumers, PaaS providers recently debuted new products and services designed to help retailers measure up to security standards and accept new forms of payments.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content