Payment Gateway vs Payment Processor: What You Need to Know

Stax

JUNE 8, 2025

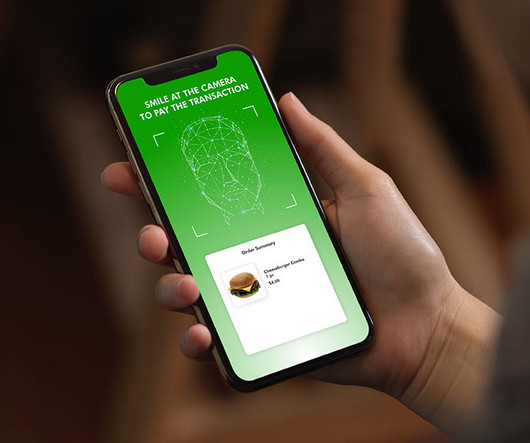

The gateway ensures that all data entered—such as the cardholder’s credit card information—is securely encrypted and then routed accordingly. They share several common features: Encryption : Both encrypt transaction and cardholder data to help protect against fraud and ensure PCI compliance.

Let's personalize your content