Automating Account Reconciliation in NetSuite

EBizCharge

JULY 14, 2025

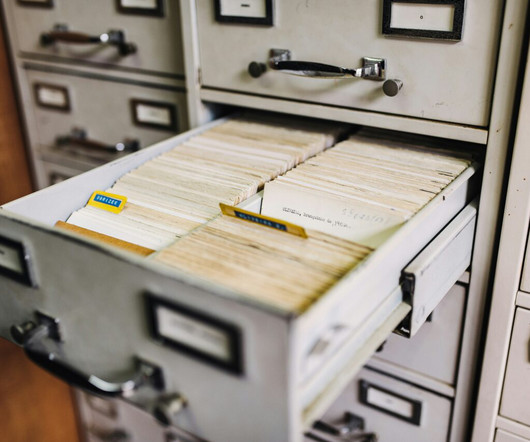

Account reconciliation may not be the flashiest part of your finance operations, but it’s one of the most important. Getting your numbers right at the end of each month, quarter, or year depends on clean, accurate, and timely reconciliation. What Is Account Reconciliation? Automation also reduces the risk of human error.

Let's personalize your content