Get Paid Faster: Adopt an AI Solution That Integrates Credit Decisions into Your CRM

Trade Credit & Liquidity Management

JUNE 23, 2025

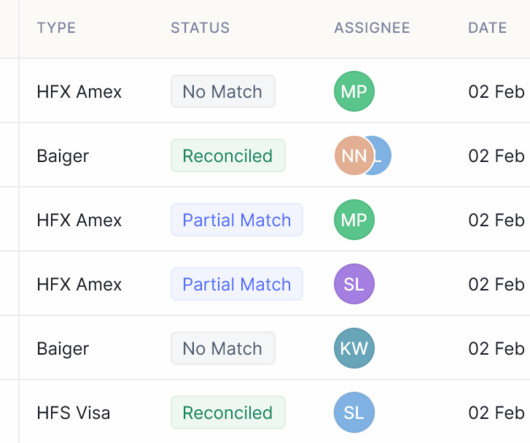

Another report by PwC found that a significant percentage of working capital is trapped due to inefficient credit approvals, with finance teams spending up to 20% of their time manually evaluating new customer risks or re-checking existing customers during renewal. Different data. Different truths.

Let's personalize your content