Jumio Rolls Out Advanced Liveness Detection to Combat Deepfakes

Fintech News

JUNE 18, 2025

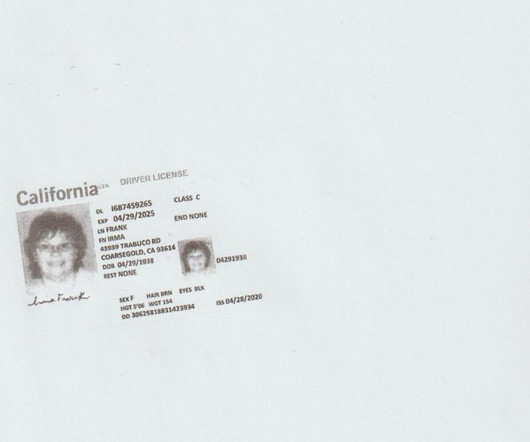

Jumio has announced the general availability of Jumio Liveness Premium with advanced deepfake detection, which it describes as its most advanced biometric liveness detection tool to date. The post Jumio Rolls Out Advanced Liveness Detection to Combat Deepfakes appeared first on Fintech Singapore.

Let's personalize your content