The future of card-based payments in a real-time world: What banks can do to stay ahead

Finextra

JULY 8, 2025

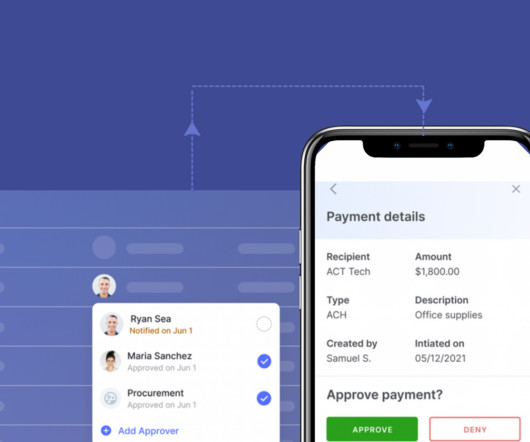

In fact, according to Statista, the value of transactions processed using RTP technology is projected to grow by a staggering 289 percent between 2023 and 2030, underscoring the dramatic shift underway in global payment ecosystems. What we’re witnessing isn’t the demise of card-based payments, but a shift in their role.

Let's personalize your content