Apple faces new payments lawsuit

Payments Dive

MAY 7, 2025

A basketball training company is suing the tech titan, which it claims unfairly collected money from potentially more than 100,000 app developers.

Payments Dive

MAY 7, 2025

A basketball training company is suing the tech titan, which it claims unfairly collected money from potentially more than 100,000 app developers.

Finextra

MAY 7, 2025

Coinbase is resurrecting a long-buried protocol for sending payments over the Internet to create an agentic payments layer that requires no human intervention.

Stax

MAY 7, 2025

Credit card surcharging has become a hot-button topic for businesses nationwide. But with complex regulations and shifting legal landscapes, it can be nearly impossible to stay up to date on your own. Stax Connect’s recent webinar, featuring CardX Founder Jonathan Razi , offered ISVs insight into this intricate challenge, providing expert guidance on surcharging compliance and a glimpse into the future of payment processing.

Finextra

MAY 7, 2025

Business payments automation firm AvidXchange is going private through a $2.2 billion deal that sees asset firm TPG take majority ownership with Corpay picking up a minority stake.

Speaker: Jason Cottrell and Gireesh Sahukar

Retailers know the clock is ticking–legacy SAP Commerce support ends in 2026. Legacy platforms are becoming a liability burdened by complexity, rigidity, and mounting operational costs. But modernization isn’t just about swapping out systems, it’s about preparing for a future shaped by real-time interactions, AI powered buying assistants, and flexible commerce architecture.

Fintech Finance

MAY 7, 2025

BigCommerce (Nasdaq: BIGC), a leading provider of open, composable commerce solutions for B2C and B2B brands, retailers, manufacturers and distributors, announced that Klarna , the AI-powered payments and commerce network, has become a global preferred payments partner. As a global preferred partner, Klarna will bring its flexible, interest-free payment options to merchants worldwide, enhancing the shopping experience and driving growth with one single integration.

Finextra

MAY 7, 2025

Fourthline, Europes leading identity services provider, has been selected by Revolut as a strategic partner following an extensive competitive RFP process.

Payments Space brings together the best content for payment processing professionals from the widest variety of industry thought leaders.

Finextra

MAY 7, 2025

dLocal (NASDAQ: DLO), a leading cross-border payment platform for emerging markets, announces today an expanded relationship with PayPal to offer businesses access to payment processing and local payment methods in more than 40 new untapped emerging markets.

Fintech Finance

MAY 7, 2025

dLocal (NASDAQ: DLO), a leading cross-border payment platform for emerging markets, announces today an expanded relationship with PayPal to offer businesses access to payment processing and local payment methods in more than 40 new untapped emerging markets. By leveraging dLocal’s platform, global customers of PayPal Enterprise Payments , previously known as Braintree, can now easily accept cards and process local and alternative payment methods across Latin America, EMEA, and APAC markets

Finextra

MAY 7, 2025

London-based fintech Sikoia, which helps financial services providers automate key processes, is partnering with Mast.

Payments Dive

MAY 7, 2025

The Consumer Financial Protection Bureau won’t prioritize enforcement actions related to buy now, pay later payments, the agency said in a notice.

Speaker: Michael Veatch, Senior Director, Implementations & Ella Aguirre, Director of Solution Consulting

Embedding payments can be a transformative step for software companies looking to enhance their platform capabilities, boost customer satisfaction, and drive long-term growth. However, the success of payments hinges on a single thing: implementation. Drawing on real-world insights and experiences, payments implementation experts Michael Veatch and Ella Aguirre will explore actionable strategies that can lead to a transparent, friction-free launch and mitigate potential challenges like technical

Finextra

MAY 7, 2025

German neobank N26 is following in the footsteps of Revolut by entering the telecommunications market with the introduction of a digital mobile plan

Fintech Finance

MAY 7, 2025

Cardstream , a leading fintech, has partnered with Mastercard to enhance its white-label Payment Facilitation-as-a-Service (PFaaS) platform and enable its customers to offer open banking payments to merchants and retailers across the UK. With this innovation, acquirers, payment facilitators, and payment channels using Cardstream will be able to offer their merchant customers the option to accept open banking payments alongside other forms of payments such as debit and credit cards.

Finextra

MAY 7, 2025

Fiserv, Inc. (NYSE: FI), a leading global provider of payments and financial services technology solutions, today announced that Michael P. Lyons has been appointed Chief Executive Officer of Fiserv.

Bank Automation

MAY 7, 2025

The U.S. Senate has introduced a Guiding and Establishing National Innovation for U.S. Stablecoins (GENIUS) Act, which seeks to provide clear guardrails and proper regulatory oversight for the development of stablecoins. We believe the United States should be the premier destination for digital assets, Treasury Secretary Scott Bessent testified at a House Financial Services Committee […] The post Senate proposes GENIUS Act to provide clarity on stablecoin, payments appeared first on Bank A

Speaker: Benjamin Woll, Tiffany Spizzo, and Jaime Santos Alcón

Enterprise commerce is at an inflection point. Rigid, monolithic platforms slow brands down, but a full replatforming is disruptive and costly. Modular architecture offers a flexible, scalable alternative - allowing enterprise brands to modernize without ripping and replacing their entire stack. Learn how a composable approach helps modernize commerce stacks while maintaining control over critical systems.

The Fintech Times

MAY 7, 2025

Sage , the accounting, financial, HR, and payroll technology provider for small and mid-sized businesses (SMBs), has announced that it is extending its collaboration with Amazon Web Services (AWS) to develop innovative AI solutions ideally suited for the accounting and compliance needs of SMBs. By leveraging AWS AI services like Amazon Bedrock and purpose-built AI chips like AWS Trainium and AWS Inferentia, Sage has been able to accelerate development, scale innovation, and deliver AI-powered so

Bank Automation

MAY 7, 2025

Small businesses in tech-forward cities are rapidly adopting AI to streamline operations and regain their most valuable resource time. Forty percent of SMBs in Boston and San Diego have adopted AI tools, according to a Chase report published May 5 in conjunction with National Small Business Week, which runs from May 4 through May […] The post SMBs in tech-forward cities embrace AI appeared first on Bank Automation News.

Fintech Finance

MAY 7, 2025

TrueLayer , Europe’s fastest growing payments network, has announced its biggest month ever, processing over $10 billion in total payment volume (TPV) in April – equivalent to more than $100 billion on an annualised basis. TrueLayer is rapidly becoming the go-to choice for instant, secure and low-cost payments across sectors, including eCommerce, food and beverage.

BioCatch

MAY 7, 2025

When someone becomes a victim of fraud, the emotional and psychological toll can be just as devastating as the financial loss. In many cases, the first person they reach out to is not a loved one or the police but their bank. In fact, 69% of fraud victims contact their bank first. But what happens next is often where things go terribly wrong.

Advertisement

Large enterprises face unique challenges in optimizing their Business Intelligence (BI) output due to the sheer scale and complexity of their operations. Unlike smaller organizations, where basic BI features and simple dashboards might suffice, enterprises must manage vast amounts of data from diverse sources. What are the top modern BI use cases for enterprise businesses to help you get a leg up on the competition?

The Nilson Report

MAY 7, 2025

The post IDEMIA, NAPAS Partner to Enhance Digital Payments in Vietnam appeared first on Nilson Report.

Bank Automation

MAY 7, 2025

Huntington Bank has been experiencing transaction processing delays. A spokesperson at the $210 billion bank told Bank Automation News: Due to a processing issue, some Huntington Bank customers may have experienced issues accessing account information and delays in the processing of certain transactions. The issue has been resolved. Consumers started reporting issues May 6 via […] The post Huntington Bank resolves multiday outage appeared first on Bank Automation News.

The Nilson Report

MAY 7, 2025

The post AFS and Al-Etihad Al-Dawli Advance Libyan Payments appeared first on Nilson Report.

Bank Automation

MAY 7, 2025

Debt-collection service provider Akuvo is seeing rising demand for its services amid a tumultuous macroeconomic environment. The Malvern, Pa.-based company provides its financial institution clients with an end-to-end platform to streamline collections, allowing them to dedicate more time to their core operations, Steve Castagna, chief operating officer at Akuvo, told Bank Automation News.

Speaker: Becky Parisotto and John Vurdelja

Fulfillment is no longer just about getting products from point A to point B – it's about crafting seamless, scalable, customer first experiences. Flexible fulfillment strategies are more important than ever for those aiming to stay ahead and build resilience as retail enters a new era in 2025. Learn how to optimize fulfillment processes, tackle complex, multi-vendor orders, and create seamless customer experiences – from white-glove delivery for high-value items to quick-ship solutions for ever

The Nilson Report

MAY 7, 2025

The post J.P. Morgan Payments has signed an agreement to introduce Affirms flexible and transparent pay-over-time plans appeared first on Nilson Report.

Fintech Review

MAY 7, 2025

Castries, Saint Lucia, May 7th, 2025, FinanceWire PrimeXBT , a regulated multi-asset broker, has significantly broadened its instrument lineup on MetaTrader 5 (MT5), adding over 100 new assets and trading pairs across all key markets. This major update strengthens the broker’s cross-asset range and provides traders with expanded access to global financial markets through an all-in-one trading experience.

The Payments Association

MAY 7, 2025

As we navigate through 2025, high-risk merchants face a rapidly evolving fraud landscape. From AI-driven scams to rising chargeback rates, the challenges are growing more complex and costly. In 2024 alone, businesses lost $8.9 billion to chargebacks, a figure projected to rise as fraud tactics become more sophisticated. For e-commerce merchants, SaaS companies, crypto exchanges, and other high-risk industries, staying ahead of these fraud trends is crucial to protect revenue and maintain custome

Fintech Finance

MAY 7, 2025

Vistra , a leading provider of essential business services that help organizations to invest, grow and operate efficiently and compliantly across the world, today announced it has entered into an agreement to acquire iiPay, a market leader in cloud-based global payroll solutions. This strategic acquisition will significantly enhance the scale of Vistra’s payroll capabilities in the fast-growing mid-market and enterprise multi-country payroll space, positioning Vistra as a top 4 market lead

Speaker: Brad Pinneke, VP of Business Development at Payrix and Worldpay for Platforms

In this webinar, Brad Pinneke, Vice President of Business Development at Payrix and Worldpay for Platforms, will dive into the 7 must-have criteria for evaluating payments partners, helping you maximize both efficiency and the long-term value of your investment. From assessing technology capabilities to leveraging business development opportunities, this session will give you a clear, actionable strategy to select the right partner for scaling your business.

The Payments Association

MAY 7, 2025

The market for tokenised financial assets is expanding at a breakneck pace. The total value of tokenised assets is expected to reach $6 trillion this year and soar to nearly $19 trillion by 2033a staggering compound annual growth rate of 53%. Major financial players are no longer treating tokenisation as an experiment, but rather a strategic and evolutionary development in modern financial services.

Fintech Finance

MAY 7, 2025

PayFuture , the innovative payments platform connecting global businesses with emerging markets, has appointed Sanda Laicena as Group Chief Legal Officer (CLO). With over 30 years of experience spanning financial services, fintech, and legal sectors, Sanda has held senior leadership positions at both established financial institutions and high growth fintech companies across diverse international markets.

Segpay

MAY 7, 2025

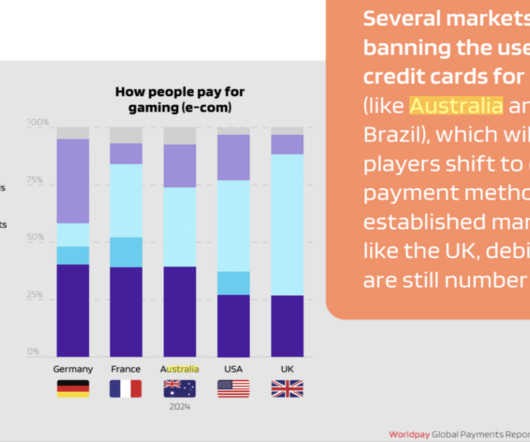

Australias iGaming market is booming and payment companies are perfectly positioned to cash in. The demand for fast, secure, and seamless payment solutions has never been greater. But this isn’t just about moving money its about powering a digital entertainment revolution. As regulatory frameworks evolve and user expectations soar, payment providers that can offer innovation, compliance, and user-centric design have a rare opportunity to lead in one of the Asia-Pacific regions most dynam

Finextra

MAY 7, 2025

Coinbase is resurrecting a long-buried protocol for sending payments over the Internet to create an agentic payments layer that requires no human intervention.

Speaker: Jennifer Wright and Nick Barron

2025 is right around the corner, and with it comes a new wave of consumer expectations, competitive pressures, and operational challenges. Success lies in finding the balance between operational flexibility and creating experiences that keep customers coming back. The future of retail belongs to those who can stay ahead of shifting customer preferences and marketing trends. 🔮 In this session, we’ll dive deep into what it takes to keep customers engaged and your operations nimble, no matt

Let's personalize your content