Global Payments mulls price increases

Payments Dive

JUNE 14, 2023

Global Payments CEO Cameron Bready called the payment services pricing environment “favorable” in light of increases rivals have made.

Payments Dive

JUNE 14, 2023

Global Payments CEO Cameron Bready called the payment services pricing environment “favorable” in light of increases rivals have made.

The Finance Weekly

JUNE 12, 2023

FP&A software plays a crucial role in helping CFOs, finance leaders, and FP&A experts maintain the financial well-being of their organizations. It enables them to monitor and analyze current financial outcomes while also forecasting future performance. Given the wide range of providers offering FP&A software, choosing the most suitable platform for your specific needs can be challenging.

Nanonets

JUNE 14, 2023

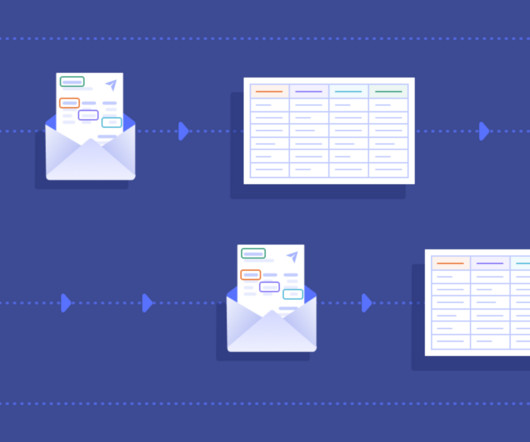

Introduction In today's digital age, managing an avalanche of emails can be an overwhelming task, especially for businesses dealing with hundreds or thousands of emails daily. However, these emails often contain vital information, from purchase orders and invoices to customer queries or even insights that could help streamline your business operations.

Agile Payments

JUNE 16, 2023

Ways How Print Ads Can Complement Digital Marketing Strategies

Speaker: Jason Cottrell and Gireesh Sahukar

Retailers know the clock is ticking–legacy SAP Commerce support ends in 2026. Legacy platforms are becoming a liability burdened by complexity, rigidity, and mounting operational costs. But modernization isn’t just about swapping out systems, it’s about preparing for a future shaped by real-time interactions, AI powered buying assistants, and flexible commerce architecture.

Payments Dive

JUNE 12, 2023

Restaurant point-of-sale company Toast has partnered with commerce fintech FreedomPay to pursue larger customers, such as Starbucks and Shake Shack.

The Paypers

JUNE 12, 2023

Global technology company Mastercard has launched Touch Card, a new product that aims to facilitate payments for blind and low-vision customers.

Payments Space brings together the best content for payment processing professionals from the widest variety of industry thought leaders.

Agile Payments

JUNE 15, 2023

Smart Investments: Tech Tools that Deliver Cost-Effective Results

Payments Dive

JUNE 16, 2023

One in five consumers worldwide have been victims of payment fraud in the past four years, according to an ACI report.

The Paypers

JUNE 16, 2023

Spain-based bank BBVA has partnered with Amazon Web Services to deliver advanced analytics and data services in the cloud, furthering its data and AI transformation process.

National Processing

JUNE 14, 2023

Merchant account security is one of the most important aspects of running a successful business. Learn some tips for keeping your account safe here. The post Merchant Account Security 101: How to Keep Your Business and Your Customers Safe from Fraudsters appeared first on National Processing.

Speaker: Michael Veatch, Senior Director, Implementations & Ella Aguirre, Director of Solution Consulting

Embedding payments can be a transformative step for software companies looking to enhance their platform capabilities, boost customer satisfaction, and drive long-term growth. However, the success of payments hinges on a single thing: implementation. Drawing on real-world insights and experiences, payments implementation experts Michael Veatch and Ella Aguirre will explore actionable strategies that can lead to a transparent, friction-free launch and mitigate potential challenges like technical

Core

JUNE 16, 2023

* Last Updated: June 16, 2023 An electronic billing system, or e-billing system, processes online payments as electronic bills and payment submissions. Citizens can submit payments on their electronic devices and the payments are sent directly to the government agency who originally sent a bill. The entire e-billing process refers to billing, payment collection, and notifications sent to both the recipient and sender.

Payments Dive

JUNE 14, 2023

The program is part of Visa’s effort to invest $1 billion in the continent’s digital transformation over five years.

The Paypers

JUNE 14, 2023

Real-time payments gateway Volt has announced that it was approved by global commerce company Shopify as a global Open Banking partner.

M2P Fintech

JUNE 16, 2023

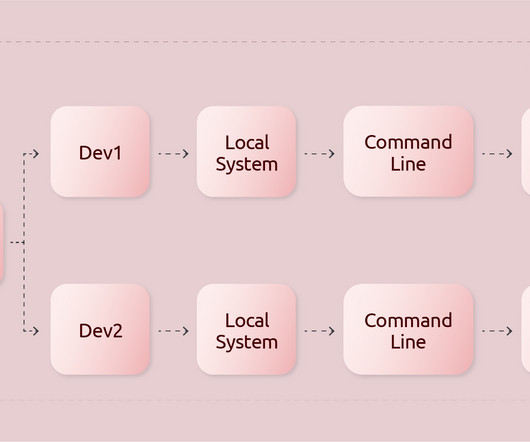

Fixing a critical bug in your code can save the integrity of your project. What is equally important is continuously improving the quality of the code, testing, and automating it for new release. Developers must make sure they follow all these processes while seamlessly communicating the changes with their team members. That’s why development teams across the world practice a mechanism called Continuous Integration (CI) and Continuous Delivery (CD).

Advertisement

Large enterprises face unique challenges in optimizing their Business Intelligence (BI) output due to the sheer scale and complexity of their operations. Unlike smaller organizations, where basic BI features and simple dashboards might suffice, enterprises must manage vast amounts of data from diverse sources. What are the top modern BI use cases for enterprise businesses to help you get a leg up on the competition?

FICO

JUNE 16, 2023

Home Blog Feed test Customer Management Trends: Hyper-Personalization, Trust, & More These were some of the top customer experience themes, breakouts, & ideas from FICO World 2023 Thu, 02/09/2023 - 10:49 Pawel Pasik by FICO expand_less Back to top Fri, 06/16/2023 - 10:25 FICO World 2023 was a hugely successful event, with more than 500 leading companies gathering at The Diplomat in Hollywood, FL to discuss top market trends, best practices, and innovative ideas in digital transformation.

Payments Dive

JUNE 14, 2023

The agency is eager to encourage open banking in the U.S., with plans for a rule proposal and oversight of standard-setting in the evolving arena.

The Paypers

JUNE 15, 2023

US-based United State Bank has announced its partnership with digital banking provider Bankjoy to offer online and mobile banking services to its account holders.

Seon

JUNE 15, 2023

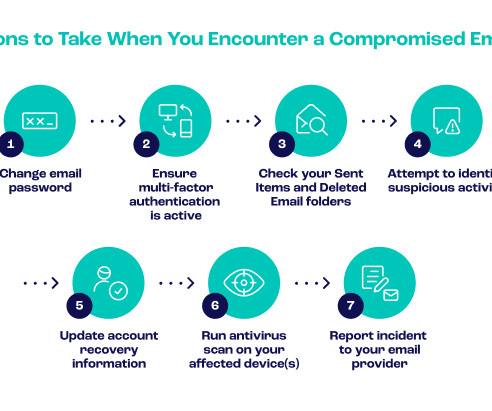

Business email compromise (BEC) attacks can be a major risk to businesses’ finances and reputations. According to the FBI’s 2020 Internet Crime Report, 2020 alone saw 791,790 complaints of suspected internet crime – an increase of more than 300,000 since 2019. Reported losses in 2020 exceeded $4.2 billion. The report states that these victims mostly lost their money to BEC scams.

Advertisement

Build a sustainable merchant services portfolio with practical strategies to ensure long-term success. Diversify across industries to spread risk and stabilize income, balancing high-risk and low-risk clients for a robust mix. Combine large and small merchants to create a resilient payment portfolio, leveraging each type's strengths. Foster long-term relationships through exceptional service and personalized support.

Nanonets

JUNE 15, 2023

Offices around the world are becoming paperless. Document management systems have replaced rooms full of business documents. On top of that, it comes with benefits like intelligent automation, fewer errors, additional savings, enhanced security, and more. And it’s growing fast. The document management software market currently stands at USD 5.5 billion in 2023 and is set to grow to USD 16.4 billion by 2029 with a 16.8% CAGR.

Payments Dive

JUNE 13, 2023

“In the U.S., we never kill payment systems,” writes Modern Treasury cofounder Sam Aarons. “People still write paper checks. But the future of money, especially inside larger enterprises, is instant payments.

The Paypers

JUNE 12, 2023

US-based data network Plaid has introduced a new identity verification experience based on a 'verify once, verify everywhere' system.

FICO

JUNE 15, 2023

Home Blog Feed test To Stop Scams, It’s Time to Add Sensible Friction to Easy Money The convenience and speed of real-time payments makes it easy for fraudsters to scam individuals. It’s time to consider sensible friction in the process. Wed, 03/08/2023 - 22:14 jessica shortt by TJ Horan Vice President, Product Management expand_less Back to top Thu, 06/15/2023 - 15:05 As someone who has made a career in the payments industry, I feel a little weird making this bold statement: it has become too e

Speaker: Benjamin Woll, Tiffany Spizzo, and Jaime Santos Alcón

Enterprise commerce is at an inflection point. Rigid, monolithic platforms slow brands down, but a full replatforming is disruptive and costly. Modular architecture offers a flexible, scalable alternative - allowing enterprise brands to modernize without ripping and replacing their entire stack. Learn how a composable approach helps modernize commerce stacks while maintaining control over critical systems.

Nanonets

JUNE 15, 2023

Accounting automation has become a game-changer in the financial world. It transforms how businesses handle their financial processes. Accounting automation can help streamline operations, reduce errors, and save time and resources. In a survey, 58% of accountants said automated accounting led to increased efficiency. US accounting services show that nearly 75% of accounting tasks can be automated.

Payments Dive

JUNE 13, 2023

The FIS unit that caters to merchants will focus on e-commerce growth after it’s spun off next year, CEO Stephanie Ferris said.

The Paypers

JUNE 14, 2023

The Bank of Thailand has revealed its plans to launch a retail CBDC pilot in a regulatory sandbox in collaboration with three payment providers.

FICO

JUNE 14, 2023

Home Blog Feed test Critical Steps to Improving Hyper-Personalization at Scale Alyson Clarke of Forrester Consulting takes a deep dive into the implications and expectations around hyper-personalization to banks and their customers Thu, 06/15/2023 - 16:50 JenniferPiccinino@fico.com by Darryl Knopp expand_less Back to top Thu, 06/15/2023 - 11:05 Research shows more than half of all decision-makers understand the importance of hyper-personalization.

Speaker: Brad Pinneke, VP of Business Development at Payrix and Worldpay for Platforms

In this webinar, Brad Pinneke, Vice President of Business Development at Payrix and Worldpay for Platforms, will dive into the 7 must-have criteria for evaluating payments partners, helping you maximize both efficiency and the long-term value of your investment. From assessing technology capabilities to leveraging business development opportunities, this session will give you a clear, actionable strategy to select the right partner for scaling your business.

Nanonets

JUNE 14, 2023

I wouldn’t be exaggerating if I said an average person sends/receives at least 10 invoices per week. With the growing digitalization, businesses are dealing with massive volumes of invoices every day. Traditionally, invoice processing has been a manual and time-consuming process, that needs significant resources and is prone to errors. With the advent of AI and Natural Language Processing, invoice processing can now be automated and streamlined, leading to improved efficiency and accuracy

Payments Dive

JUNE 12, 2023

FIS has acquired Bond, according to two news outlets, including one backed by an internal company memo.

The Paypers

JUNE 16, 2023

Cyprus-based payments platform BridgerPay has launched Paywith, a payment checkout solution that enables users to pay with any mix of payment methods.

Axway

JUNE 14, 2023

Remember the televised PSA that would ask late in the evening, “Do you know where your children are?

Advertisement

The complexity of financial data, the need for real-time insight, and the demand for user-friendly visualizations can seem daunting when it comes to analytics - but there is an easier way. With Logi Symphony, we aim to turn these challenges into opportunities. Our platform empowers you to seamlessly integrate advanced data analytics, generative AI, data visualization, and pixel-perfect reporting into your applications, transforming raw data into actionable insights.

Let's personalize your content