How EMV has grown beyond the chip on a card

Payments Source

JULY 8, 2020

The role of EMVCo — which is often seen as an extension of the card brands that deals only with chip-based EMV plastic cards— has come into sharper focus.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Payments Source

JULY 8, 2020

The role of EMVCo — which is often seen as an extension of the card brands that deals only with chip-based EMV plastic cards— has come into sharper focus.

The Fintech Times

JANUARY 20, 2025

It has been a busy first month of the year for the certified payment technology provider, DECTA as it announces a new partnership with Urbo Bank and achieves an EMV 3DS 2.3.1.1 To achieve this, a reliable payment processor is required to handle the entire card-issuing process. ” EMV 3DS 2.3.1.1 Certification.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Payments Source

MARCH 15, 2021

After postponing enforcement for years, the card brands are implementing an EMV liability shift at fuel stations, which still struggle to make the upgrades necessary for chip-card acceptance.

Stax

MARCH 4, 2025

Up to 42% of shoppers in the US abandon their cart if their favorite payment method isnt available. Meanwhile, retailers that provide at least three of the most popular payment methods in any market increase their conversions by up to 30%. Need to integrate payments? One way to do this is by offering credit card integrations.

Fintech News

JULY 8, 2025

A new whitepaper titled The Future of Global Payments & Fourth Generation Payment Networks (4GPN) has been jointly released by the Thunderbird School of Global Management and fintech firm Wiseasy. The global digital payments market is expected to grow from US$10.18 trillion in 2024 to US$32.07

Payments Dive

JUNE 14, 2019

The new EMV Secure Remote Commerce specifications may provide a solution to a longstanding problem with ecommerce checkout creating friction for consumers and being vulnerable to fraud.

Payments Source

SEPTEMBER 13, 2016

Nearly a year after the October 2015 liability shift, a mere 17% to 37% of all US merchants have adopted EMV POS terminals.

Payments Source

NOVEMBER 11, 2020

EMVCo, the major card brand-supported venture to establish EMV guidelines and specifications, has begun testing a program to determine if consumer mobile devices can securely accept contactless payments — a move that not only hastens the adoption of contactless payments, but renews criticism over which networks control technology and routing decisions. (..)

Payments Source

OCTOBER 6, 2016

As more merchants worry about EMV card slowdowns ahead of the holiday shopping season—when bottlenecks at checkout points could lead to many lost sales—more companies are coming up with their own ways to slash EMV payment times.

Payments Dive

JUNE 15, 2017

Pay-at-the-table devices, which generally accept both EMV and contactless payments, could start to appear at restaurants in a big way during the next couple of years.

Fintech Finance

NOVEMBER 6, 2024

XPP becomes the umbrella organisation under which the specialised payment solutions Vayapay, Ginger Payments, KUARIO, and Pecunda operate. XPP represents a significant milestone for XMDS Holding, reaffirming its commitment to excellence in payment solutions. The brands under XPP have established a strong international position.

Payments Source

OCTOBER 2, 2016

EMV chip cards have delivered on their promise to halt counterfeit fraud at the physical point of sale. But for a technology developed long before the invention of e-commerce, mobile wallets and the word "omnichannel," delivering on its promise still feels like falling short.

Stax

JUNE 8, 2025

Industry data shows that 70% of consumers say the availability of their preferred payment method is very or extremely influential when choosing an online store. A payment processor and payment gateway are both crucial components in transactions, as they enable the various ways that shoppers want to pay.

NFCW

NOVEMBER 20, 2024

CILAB CI230: Now able to validate EMV interoperability and payment acceptance on NFC devices PARTNER NEWS: The Cilab ci230 high speed test bench now includes support for testing NFC device compliance with EMVCo’s new reduced range testing process for contactless payments acceptance on standard NFC devices.

Payments Source

OCTOBER 20, 2016

While card issuers took a step in the right direction by replacing the fraud-prone magnetic stripe cards of the past, they made many missteps that complicated and weakened the EMV transition.

Payments Source

NOVEMBER 14, 2016

Biometrics can help solve this problem, and will also prove handy as EMV cards migrate to smartphones. There are security gaps in chip cards that are vulnerable to new types of skimming.

Payments Source

FEBRUARY 28, 2016

EMV liability shift for counterfeit card fraud went into effect, most restaurants aren't processing chip cards, and that's not changing anytime soon, according to a top executive at Heartland Payment Systems. Five months after the U.S.

Payments Source

SEPTEMBER 19, 2016

In order to successfully and scalably combat card-related fraud and digital payments hacking, organizations need to rely less on standards like EMV and PAN/PRN, and recognize today’s currency is no longer just about money.

Payments Source

APRIL 9, 2020

With the EMV liability shift date for automated fuel dispensers (AFD) looming, subject to any last-minute changes, we are seeing major changes at fuel sites across the USA. With close to 150,000 active fuel sites in the US alone, there are a huge number of individual pumps that will need to be upgraded to accept chip and PIN cards.

Fintech Finance

JANUARY 2, 2025

EMVCo , the global technical body for the payment community, has received ISO/IEC 17065 accreditation for its security evaluation processes. Its new status as an accredited certification body recognises the value and quality of EMVCo security product evaluations in enabling the deployment of safe and secure payment solutions.

Stax

MAY 6, 2025

Credit cards are a staple in the wallets of consumers today, and they will undoubtedly be a payment method of choice for years to come, particularly as the adoption of mobile and contactless payments continues to grow. In fact, ResearchAndMarkets.com forecasts the global credit card payment market to grow to $762.16

Payments Dive

MAY 29, 2018

New foodservice technologies — including self-order kiosks, mobile ordering and EMV-enabled payment systems — are being introduced at a rapid pace. Operators with existing POS investments need to be able to integrate new capabilities into their existing systems.

Stax

NOVEMBER 14, 2024

And yet, accepting non-cash forms of payments is more or less required to operate a modern business, at least in the U.S. Credit, debit, and digital payments have far and away become the most popular payment method. Cash has dropped to less than 20% of all US payments in recent years.

Payments Source

APRIL 19, 2016

On any given day, there are countless articles circulating about the issues associated with EMV and how it will soon be replaced by the next big thing. However, EMV is here to stay, and, despite some who claim otherwise, that’s a good thing.

Payments Source

SEPTEMBER 26, 2016

’s $49 contactless card reader, there’s a new enticement to consider: Square has sped up the time it takes to accept EMV cards by 1.5 For merchants still on the fence about whether to buy Square Inc.’s seconds.

Payments Source

MAY 4, 2020

gas station EMV compliance, but that’s just one of a mounting set of challenges petroleum merchants are facing because of the coronavirus. Visa’s the first card company to push back the October deadline for U.S.

Payments Dive

MARCH 23, 2018

The future state of self-service is turning the kiosk into a stand-alone store, and secure payment is one of the services that needs to be offered for it to be effective, says Ingenico's John Menzel, who recently shared his insights on EMV compliance in self-service.

Payments Dive

APRIL 30, 2019

Retailers need to consider shedding their legacy POS systems to enable mobile payment acceptance, business analytics, EMV security and better inventory management.

PYMNTS

FEBRUARY 13, 2019

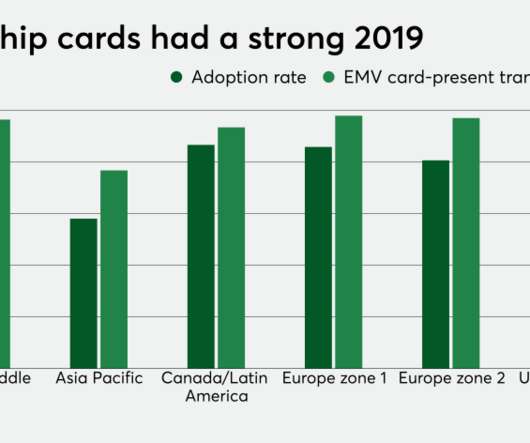

Merchants saw a drop in card-present fraud due to the increased adoption of Europay, Mastercard and Visa (EMV) chip cards, Visa said. million merchants now accept chip cards, which is an increase of 692 percent since the beginning of EMV migration, and almost 70 percent of storefronts in the United States now accept chip cards.

Payments Source

MARCH 17, 2016

Consumers who have been issued EMV chip cards know how to use them. So it might come as a surprise when merchants equipped with chip card readers instruct their customers to swipe their cards instead.

Clearly Payments

MARCH 4, 2025

For many small businesses, payment processing fees are a significant expense that eats into profits. However, one small business managed to save $10,000 a year on payment processing without sacrificing customer convenience. Analyzing Payment Processing Costs Many business owners assume they are paying lower fees than they actually are.

Payments Source

APRIL 22, 2020

There is no denying that the upgrade to EMV will reduce certain types of fraud by noticeable amounts, but there should be no illusion that this is a “silver bullet” to a growing fraud trend, says The ai Corporation's James Crawshaw.

PYMNTS

AUGUST 13, 2020

PAAY has rolled out a partner platform to let merchants and payment providers implement and track EMV 3DS, a standard that aims to help prevent unauthorized card-not-present (CNP) transactions, throughout different merchant accounts. seconds on average through EMV 3DS.

Fintech Finance

OCTOBER 18, 2024

Fime is proud to announce that it is the first to offer testing services in line with the EMV®* C-8 Contactless Kernel Specification**. This new approach is set to significantly streamline the development, testing and launch of new contactless payment terminals for vendors, merchants and solution providers.

Stax

MARCH 6, 2025

The desire for frictionless payments skyrocketed contactless transactions to 8.1 The system generates a one-time encrypted code for each transaction, preventing fraudsters from stealing payment data. This is why 90% of shoppers still prefer contactless payments post-pandemic. billion during the COVID-19 pandemic.

Payments Source

SEPTEMBER 12, 2018

EMV coverage has gaping holes—including smaller financial institutions that haven’t fully converted to EMV and millions of merchant locations still not accepting chip cards.

Stax

JULY 7, 2025

Building loyalty as a business means meeting your customers where they are, especially where payment options are concerned. Thanks to smartphones and secure authentication, mobile payments continue to explode in usage. Mobile payment systems are revolutionizing how consumers pay for goods and services.

Payments Dive

SEPTEMBER 15, 2020

Contactless payments offer the same strong security as EMV cards but how do they stack up against the needs of consumers who are now dealing with the aftermath of COVID-19? Jaime Topolski, the director of payment card products at Fiserv gives his insight on contactless cards.

Payments Source

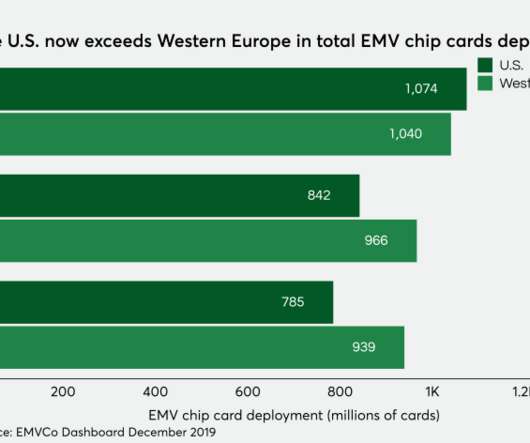

MAY 29, 2020

American financial institutions have surpassed 1 billion EMV chip cards in force to take second place in total EMV cards deployed, behind only the global leader, Asia Pacific.

Payments Source

MAY 18, 2020

In line with the other major card brands, Mastercard is extending its EMV liability shift at gas pumps to April 2021. It is also launching a data-driven fraud protection tool for fuel merchants who have not completed their upgrade to chip-card EMV pumps.

Payments Source

FEBRUARY 22, 2019

Fuel payment options in the trucking industry have long relied on private-label cards from giants like Comdata and WEX, but a new challenger called Gas Pos is hoping to break in by capitalizing on new payments technology and the looming gas-station EMV migration.

PYMNTS

AUGUST 14, 2020

Selling an EMV 3DS (also referred to as 3DS 2.0) When PAAY , a software-as-a-service company that protects merchants from fraud and increases authorization rates first started offering EMV 3DS, it had to do a lot in educating potential clients in the face of many saying: “We don’t want to hear about this.” The Path Forward .

Payments Source

AUGUST 31, 2020

We anticipate the trend towards payments that limit contact to continue beyond COVID-19, says EMVco.'s s Brian Byrne.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content