Runa Introduces Runa Assure: Proactive Security for Payout Protection

Fintech Finance

FEBRUARY 20, 2025

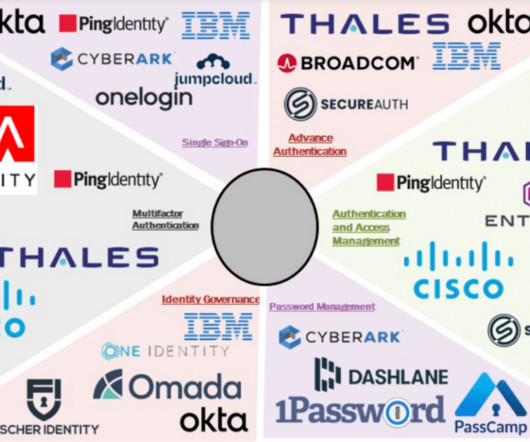

Key security features include: Advanced Machine Learning Fraud Detection: Prevent unauthorized access with IP Allowlisting & Multi-Factor Authentication (MFA), and monitor suspicious activity with user behavior analytics.

Let's personalize your content