Payment orchestration: Beyond transaction routing

The Payments Association

MAY 16, 2025

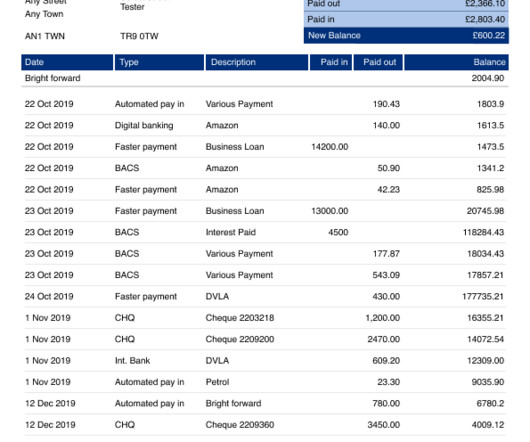

By consolidating payment data from multiple providers, these platforms offer merchants a comprehensive view of payment performance, customer behaviour, and fraud trends. This visibility enables data-driven decision-making and facilitates effective troubleshooting of issues like high decline rates or chargebacks.

Let's personalize your content