Automated and Data Driven Financial Planning Hasn’t Reached its Full Potential

The Finance Weekly

APRIL 5, 2022

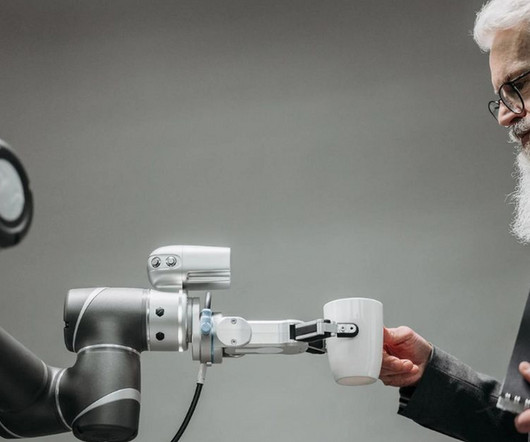

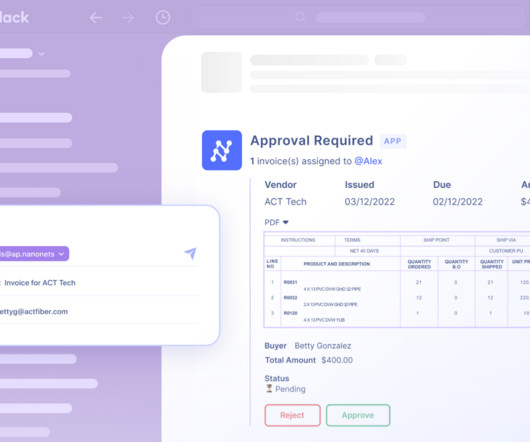

However, one department seems to lag behind when it comes to communication procedures: the finance department. The impact of data driven financial analysis goes well beyond its traditional role of budgeting and forecasting, and has the potential to contribute greatly as a forward thinking department for real-time decision making.

Let's personalize your content