How PCI DSS Compliance Protects Australian Businesses from Data Breaches?

VISTA InfoSec

MARCH 13, 2025

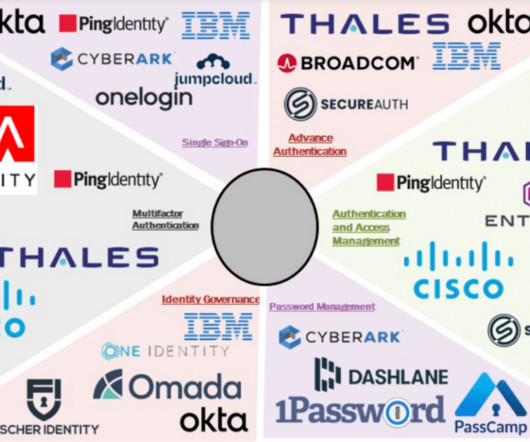

4.0 , was released on March 31, 2022, introducing enhanced security measures to address evolving cyber threats. Through multi-factor authentication (MFA) and role-based access controls, businesses can limit exposure to potential breaches by restricting access based on job responsibilities. The latest version PCI DSS v.4.0

Let's personalize your content