What is ACH Credit and ACH Debit and How Do They Work?

Stax

NOVEMBER 13, 2024

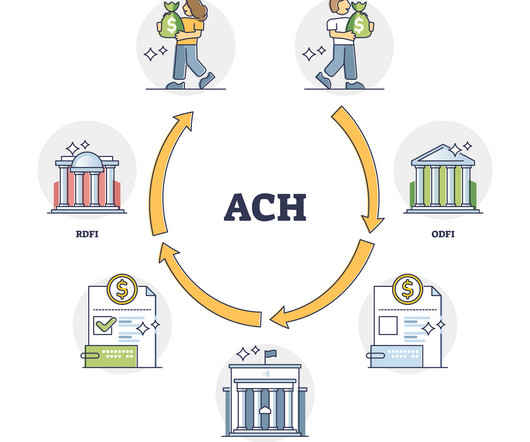

All ACH payments are secure and reliable, available 24 hours a day, 7 days a week, and 365 days a year. Making a payment via the ACH network differs from making a payment with a credit card in that you are sending the money directly from one account to another, instead of charging it to a card you would later be liable to repay.

Let's personalize your content