TCB Pay Expands to ACH Payments: The Flexible Alternative to Credit Cards

Fintech Finance

JANUARY 10, 2025

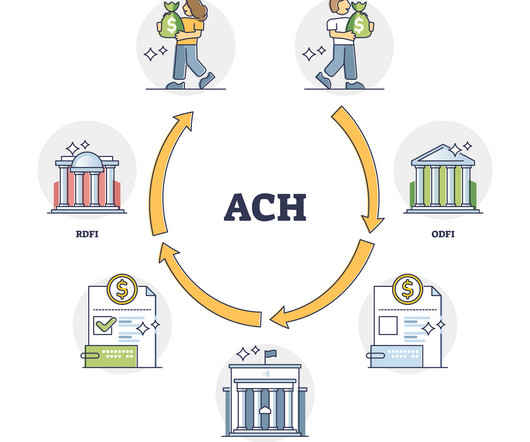

TCB Pay , a leading provider of corporate cards and payment solutions, is thrilled to announce the expansion of its services to include Automated Clearing House (ACH) payments.

Let's personalize your content