APAC Sees 23% Decline in Crypto Fraud

Fintech News

MARCH 24, 2025

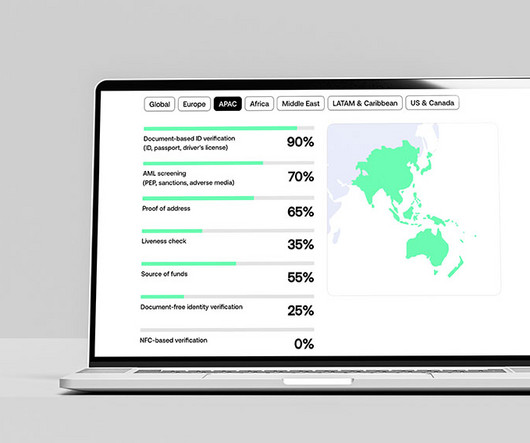

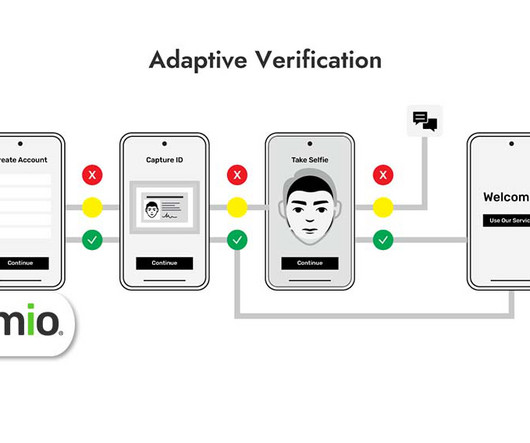

Cryptocurrency fraud is declining in Asia-Pacific (APAC), driven by advanced technology adoption and stricter regulatory oversight. According to a new report by Sumsub, crypto fraud rates declined by a remarkable 23% between 2023 and 2024, positioning APAC as a leader in combating crypto fraud.

Let's personalize your content