Payment orchestration: Beyond transaction routing

The Payments Association

MAY 16, 2025

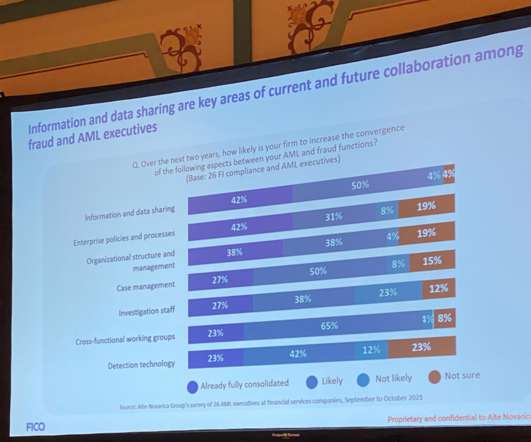

These tokens are useless if intercepted, significantly mitigating the risk of data breaches. Additionally, orchestration platforms deploy AI-powered fraud detection tools to analyse real-time behavioural data, enabling them to flag suspicious activity proactively. This supports robust risk management strategies.

Let's personalize your content