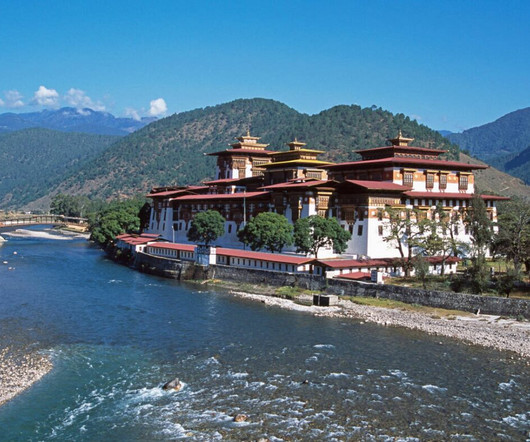

Tradition and Technology: Bhutan’s Journey into Fintech and Financial Inclusion

The Fintech Times

NOVEMBER 2, 2024

A handicrafts shop manager in Thimphu described the challenges posed by the lack of ATMs, credit card authorisation systems, and other financial infrastructure catering to international customers.

Let's personalize your content