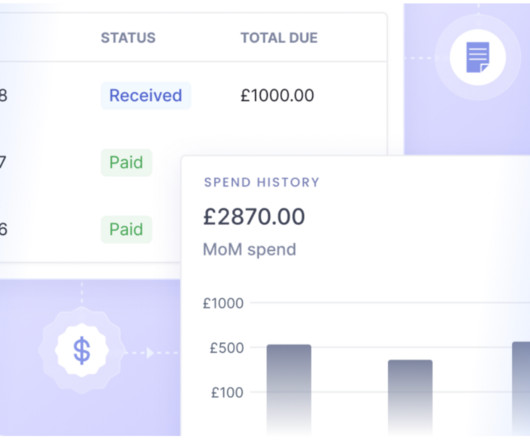

Automated and Data Driven Financial Planning Hasn’t Reached its Full Potential

The Finance Weekly

APRIL 5, 2022

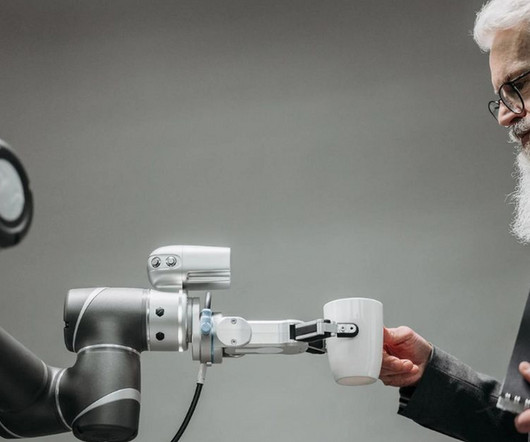

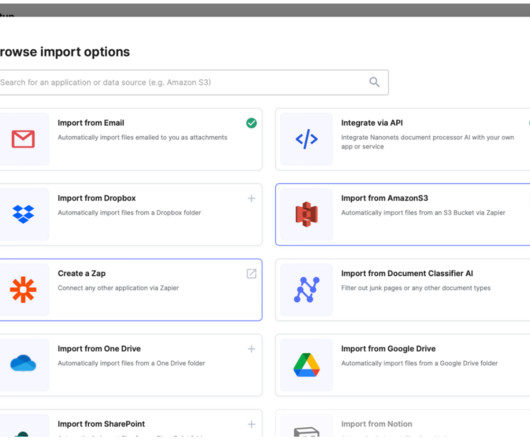

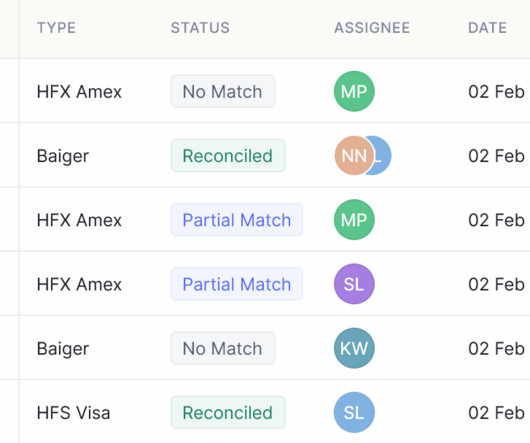

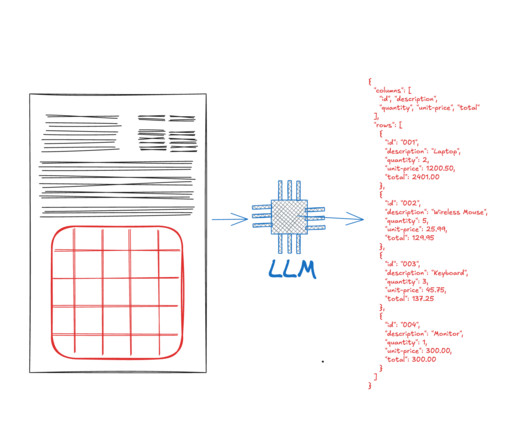

Integrated working platforms, automation, and newer and faster ways to translate data into results are all constantly being improved. A big part of these changes is increased communication between technology teams and other business departments. The way businesses conduct operations are changing at breakneck speeds.

Let's personalize your content