10 Best Practices for FP&A

The Finance Weekly

FEBRUARY 23, 2025

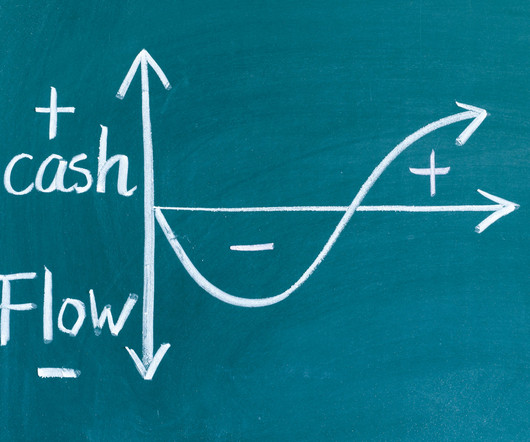

Bad data, inaccessible information, and outdated processes make FP&A more difficult. Strong FP&A practices help finance teams improve data accuracy , use technology effectively, and make well-informed financial decisions. This issue hampers forecasting accuracy, risk management, and resource allocation.

Let's personalize your content