Behavioral Scoring: The Smart Approach to Line of Credit Risk Management

Finezza

APRIL 23, 2025

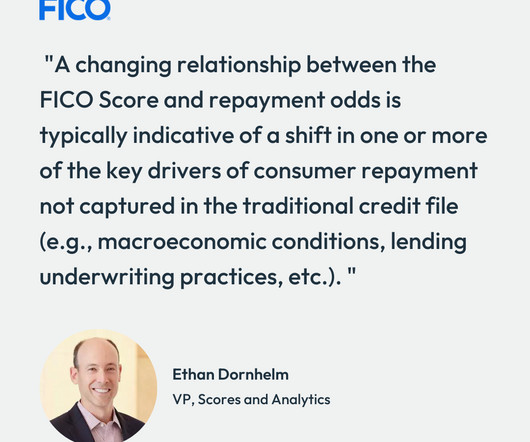

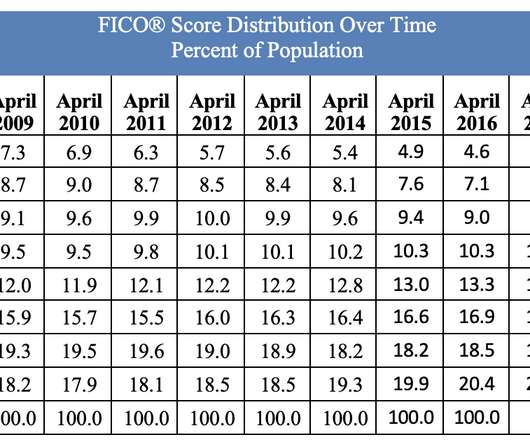

However, traditional credit scoring models do not account for an individuals lack of credit history or other important parameters, including […] The post Behavioral Scoring: The Smart Approach to Line of Credit Risk Management appeared first on Finezza Blog.

Let's personalize your content