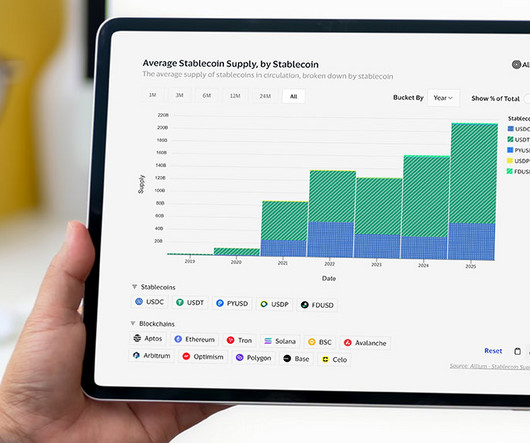

What we can expect from crypto and payment services in 2025

The Payments Association

DECEMBER 9, 2024

The upcoming changes in cryptocurrency regulation and its impact on payment services, focusing on the UK’s approach compared to the EU. It outlines how the regulatory landscape for cryptocurrencies in the UK will evolve, affecting businesses and compliance. What’s this article about? Why is it important?

Let's personalize your content